There's No Such Thing As A Green Bank Or A Fair Game

Banking is corrupt. Basketball is corrupt. This week's news blows it all out in the open.

“On all levels American society is rigged.” - John Steinbeck

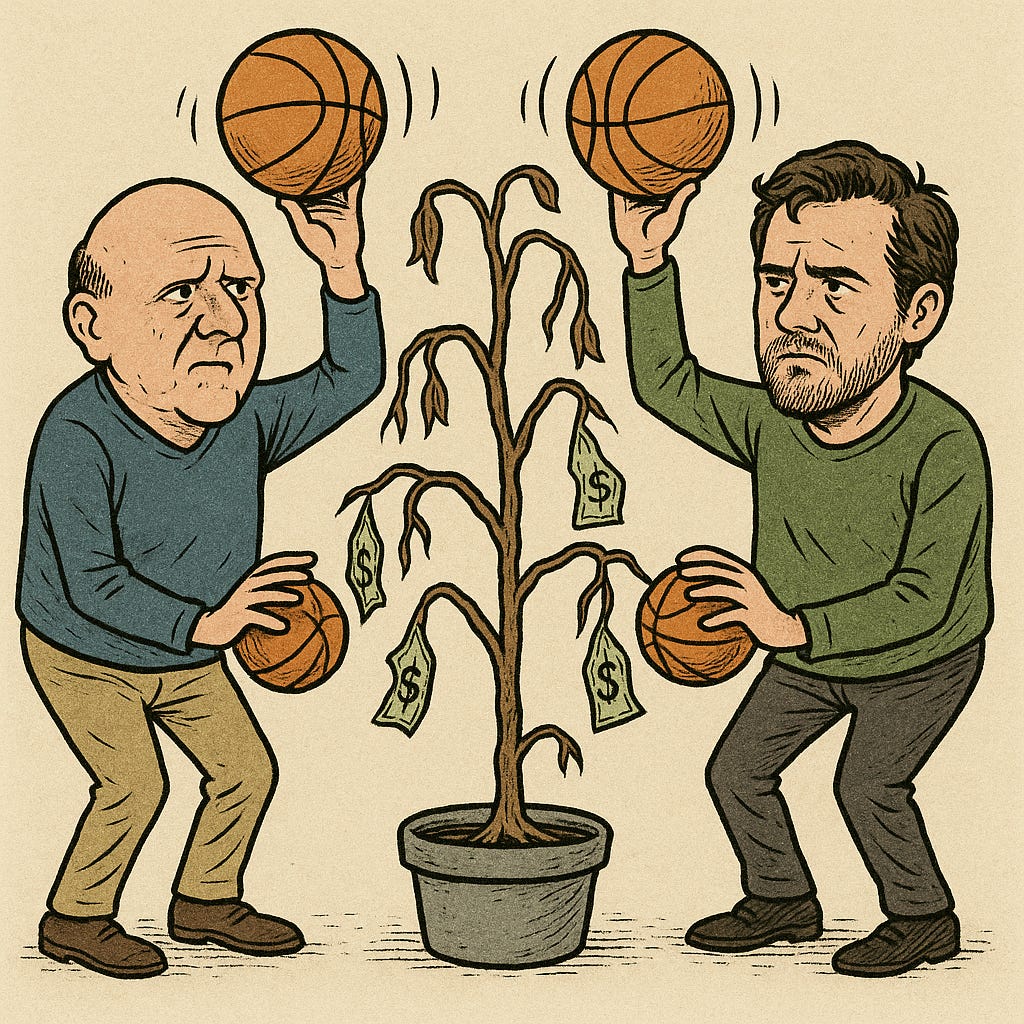

Tree-planting, poverty fighting, fossil-fuel avoiding Joseph Sanberg pleaded guilty to wire fraud charges on Monday.

The charges stem from a $248 million scheme to dupe investors through his allegedly green fintech company, Aspiration.

In 2021, this do-gooder’s upstart bank took out billboards that read, “Clean rich is the new filthy rich.” His company bragged it had planted 35 million trees. His investors included celebrities Leonardo DiCaprio, Orlando Bloom, Robert Downey Jr. and Drake.

Call it integrity theater: Moral branding wrapped around garden variety financial frauds we find across banking industry and all around the world of Big Business.

Prosecutors say Sanberg, 46, faked bank statements, invented phantom revenue, and inflated cash balances while preaching the gospel of sustainability. And when the green in his green bank finally ran out, it filed bankruptcy in March leaving investors in the dirt.

“This so-called ‘anti-poverty’ activist has admitted to being nothing more than a self-serving fraudster,” said Acting U.S. Attorney Bill Essayli in an August press release. “I urge the investing public to use caution and beware of wolves in sheep’s clothing.”

A wolf in sheep’s clothing? More like a dog in a Clippers jersey.

Enter Clippers owner Steve Ballmer, the former Microsoft CEO who was … get this: An early investor in Aspiration.

In 2021, Ballmer inked a $300 million sponsorship deal between the Clippers and Aspiration, and he personally pumped millions into the startup bank.