Ain't No Billionaire's Son

David Bren, the disowned son of the nation's richest real estate mogul, sold his investors the 'ultimate man cave.' Then he caved.

“My hair stands on end at the cost and charges of these boys. Why was I ever a father! Why was my father ever a father!” – Charles Dickens.

Sit right back and you’ll hear a tale. A tale of three fateful blunders.

Blunder No. 1: At age 93, Donald Bren should be counting his last days. Instead, he’s counting his money.

Forbes lists Bren as “America’s wealthiest real estate baron” with a net worth of $19.2 billion. And for a mere $2 million or so, the chairman of The Irvine Co. could easily bail out his wayward son, but he won’t.

The Southern California billionaire would only spare 12 words for his son – through his spokesman, no less – when The Los Angeles Times recently approached him with a litany of questions.

“We do not have a personal or business relationship with this individual,” spokesman Paul Hernandez, told the Times.

On Monday, the newspaper detailed the nauseating folly of Bren’s 33-year-old son, David, who had been recruiting investors to help him build the world’s most outrageous man cave.

The New York Post recapped his story in this free version for everyone to see: “Richest US real estate baron disowns son in savage 12-word statement over alleged ‘ultimate man cave’ scam.”

Oh, the shame. One of America’s most successful investors would not have to be remembered this way if only he’d been willing to spare what amounts to billionaire lunch money.

But no.

Blunder No. 2: So then there’s David. And oh, David, what have you gotten yourself into this time?

At the age of 18, David and his then 22-year-old sister, Christie, tried unsuccessfully to sue their father for $400,000 a month in back child support. That’s $400,000 a month, each, or about eight times the median annual income in the U.S. at that time.

Didn’t David get the message then?

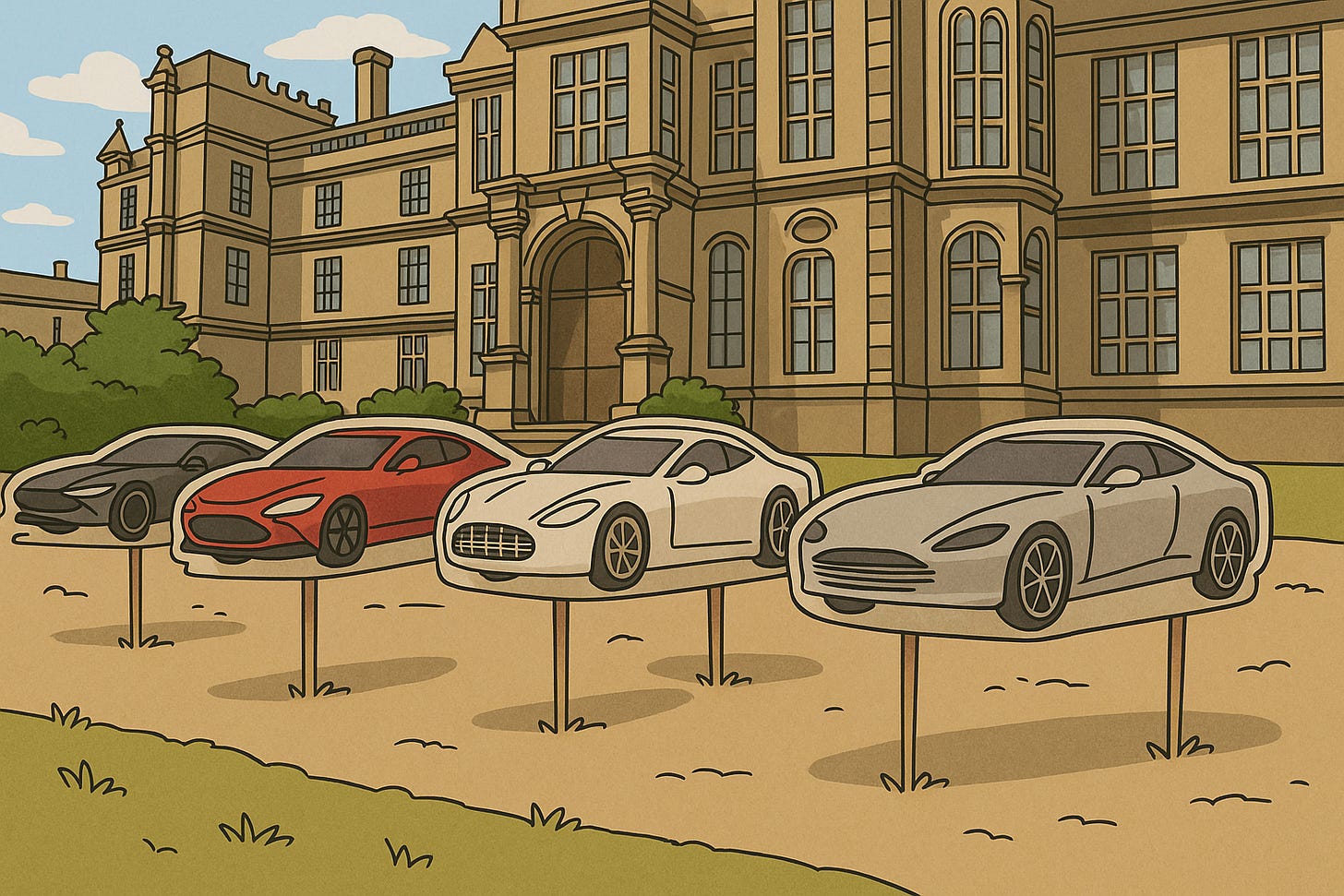

Instead David went running around Los Angeles trading on his father’s name, recruiting investors for “The Bunker,” which he described in an investor slide deck as “the ultimate man cave.”

Bren promised to acquire Mr. C’s Beverly Hills Hotel for $90 million and load it up with a fleet of supercars, including Ferraris, Bugattis and Porsches, according to an investor deck obtained by The Times.

Members would be treated to fabulous dining with pricey wines and cigars, and have access to amazing cars and luxurious private spaces. All this for just $14,500 a month.

Bren claimed his founding members included Mark Cuban, fashion designer and L.A. oil fortune scion August Getty, NBA champion Kristaps Porzingis and Oracle founder Larry Ellison, the Times reported.

This is the kind of idea that an overprivileged nepo brat comes up with. But jilted investors say “The Bunker” was bunk.

“The Bunker does not exist. There is no ultra-high end automotive club. There are no members. The business is a mirage,” one lawsuit reviewed by the Times alleged.

It was just a charade to fund Bren’s extravagant lifestyle, one lawsuit alleged.

Bren hasn’t commented on the civil allegations against him in a stack of lawsuis, but unnamed people close to him told the LA Times that he started off with good intentions. He just ran into too many obstacles, beginning with the Covid-19 Pandemic.

Yes, entrepreneurs often fail. There’s generally no crime in that. But it’s best not to fail this spectacularly while all the world is watching because your daddy is a billionaire.

Blunder No. 3: Investors somehow believed a billionaire’s genetics guaranteed a billionaire’s business sense. In this case, the lucky sperm club wasn’t so lucky.

The hotel was never acquired. The supercars never so much as sputtered. The checks were in the mail, but they bounced like jalopies on a dirt track – including a $500,000 check that Bren wrote to investors who wanted out, according to a lawsuit.

Didn’t investors stop to wonder why a billionaire’s son needed their money?

Didn’t they do at least a little due diligence and surface the 2010 report in the LA Times when Donald Bren defeated his children’s lawsuit? Or even a similar report in The Wall Street Journal?

Did they even consider that a business model based on the vanity of the wealthy might be an illusion? Especially in La-La-Land of all places?

As they say in Hollywood, never buy the movie rights until you read the script.

[NOTE: Thanks to one of my most loyal readers for suggesting this blunder. Readers can always send their suggestions to al.lewis@tellittoal.com

But wait! There’s more …]