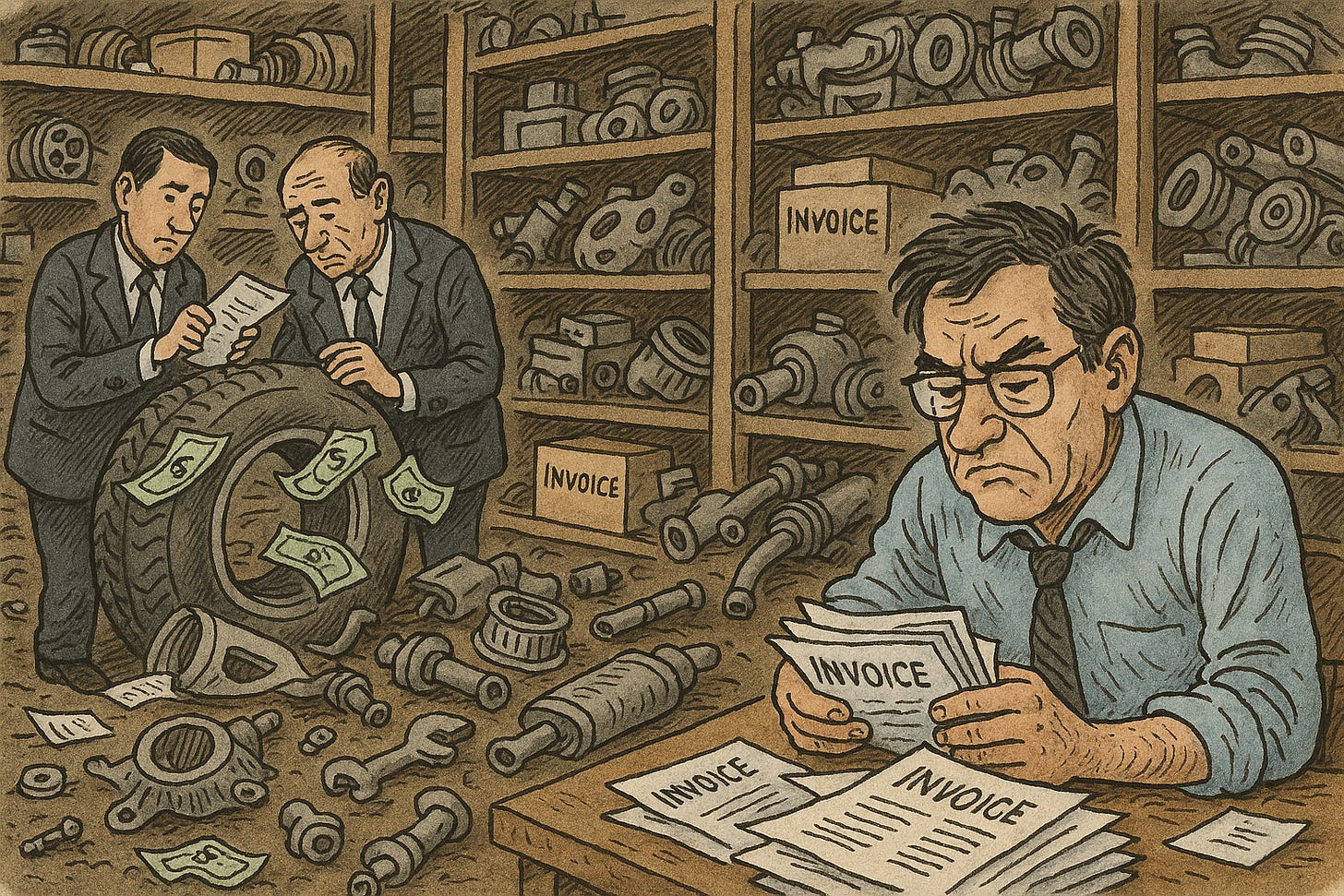

Parts Is Parts

A secretive billionaire just exited from one of the biggest corporate scandals in years. It began with auto parts.

“Anybody who knows about capitalism knows that bankruptcy is an essential part of capitalism.” – Joseph Stiglitz

Where did $2.3 billion go?

Bankruptcy lawyers, forensic accountants and even Justice Department investigators are sifting through the wreckage of an auto parts conglomerate trying to find it.

Cleveland, Ohio-based First Brands Group landed in bankruptcy court on Sept. 29 following an astonishing feat of … what shall we call it for now? … financial engineering?

On Tuesday, its founder, CEO and sole equity owner Patrick James resigned after his company stuck lenders with $12 billion in unpaid debts.

James somehow convinced investment banks and finance companies to loan him this insane amount of money to buy out 25 auto-parts brands over the past few years.

He acquired Fram oil filters, Autolite spark plugs and ANCO wiper blades. He acquired so many products that are likely in the car you drive. Or if you do your own work, you might buy them at AutoZone, Pep Boys, O’Reilly Auto Parts, or even Walmart or Amazon.

In a little over a decade, James built an auto parts empire with as many as 26,000 employees. He did this one acquisition at a time. He did this, to a large extent, with short-term loans backed by unpaid invoices.

In finance, this is known as factoring. Go to a big customer and offer to provide products they won’t have to pay for 60 to 90 days. Then use the unpaid invoices to collateralize loans – and poof, instant cash!

What’s really lucrative is if you can pledge the same invoices twice or even multiple times.

This is what some jilted lenders claim First Brands did, and what the Justice Department is investigating, according to reports in The Financial Times and The Wall Street Journal. This is where they think the missing $2.3 billion went and why this debt-bloated company just imploded.

For his part, James blames tariffs, interest rates and industry headwinds. A spokesperson told FT he “has always conducted himself ethically.”

First Brands is already one of the biggest private-capital blunders since shared office space provider WeWork imploded in 2019.

Investment banks, hedge funds and finance companies around the world are collectively eating billions of dollars in losses – and they deserve it for lending to a relatively unknown entrepreneur with a long history of debt defaults and lender lawsuits.

These unwary titans of finance who bought into this junk yard reportedly include Jeffries Financial Group, UBS and Blackstone. Then there’s Raistone Capital, a factoring giant that purchased or financed invoices from First Brands and its subsidiaries, and many, many others.

The calculous of these wizards now resembles how Wendy’s once described the dull thinking of its chicken-slinging competitors, “Parts is parts.”

Worse, the scale of their financial recklessness is evoking the cockroach theory.

FT concludes:

“Some fear that, rather than a freak occurrence, First Brands is an omen of corporate flame-outs to come after years of loosening lending standards.”

We can forgive investment bankers, hedge fund managers and finance professionals for not knowing the difference between an oil filter and a spark plug. But do they know the difference between an asset and a liability?

And who is this mysterious paper billionaire to be trusted with all this loot? FT only scratches at the answer:

“With billions of dollars apparently missing without trace, James has gone from one of America’s least-known billionaires to the face of one of its biggest corporate scandals in years.”