Instant Ponzi – Just Add Water

This Week In Blunders – Aug. 10-16

“Ponzi schemes don’t trickle down, they siphon up.” – Heather Marsh

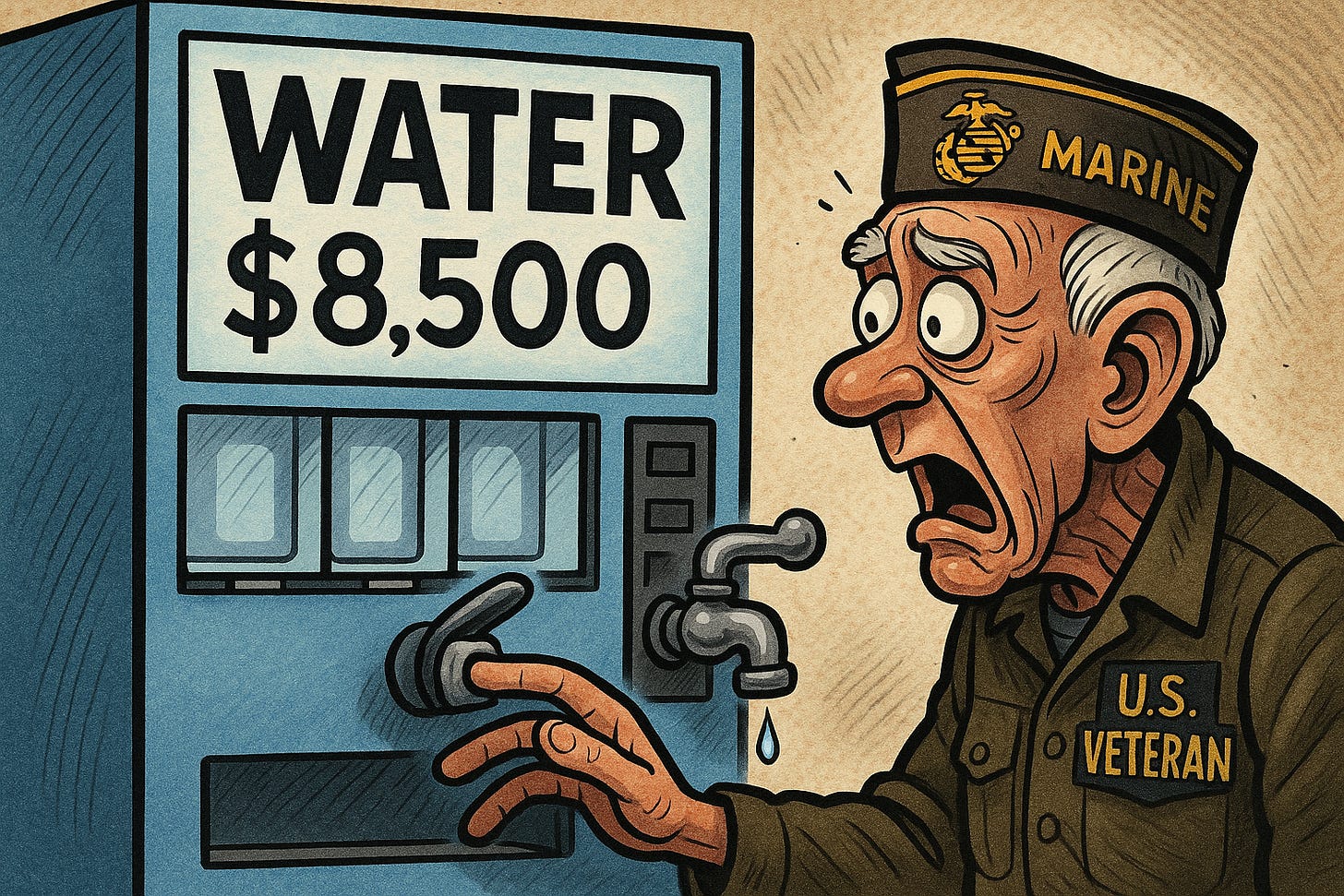

America’s fighting men and women come home thirsty. What they need is an $8,500 vending machine that spits out purified water.

Enter Water Station Management and the WST-700, the brainchild of Ryan Wear, an Everett, Wash., vending machine entrepreneur.

Wear, 49, built his empire selling his WST-700 vending machines to veterans looking for passive income. But instead of a revenue stream, they got soaked in a $275 million alleged Ponzi scheme, according to an indictment unsealed on Thursday.

Some investors were sold machines that didn’t exist. Others got machines Wear had sold to several others at the same time. Overall, the machines didn’t deliver the promised cash flow, prosecutors alleged.

Read More: 15 Tales Of Lost Ponzi Riches

Who knew you could build such a huge Ponzi scheme out of water? Not oil. not gold, not bitcoin, not even Beanie Babies. Just a little H-2-Oh no.