The Biggest Business Blunders Of All Time

And the costly lessons they left behind

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” – Warren Buffett

The history of big business is littered with more wreckage than the Bermuda Triangle.

Miscommunications, bad mergers, regulatory violations, product failures, reputational blowups and outrageous frauds have sunk more companies that most of us can remember. But great business minds will remember all of these failures as cautionary tales.

Learn from the deals gone bad, the launches that flopped, and the multibillion-dollar mishaps that have cost companies and careers dearly.

Here’s a free compendium of the biggest blunders in corporate history, many of which still reverberate through the news cycle to this day.

Kodak Shelves Digital Photography – 1975-2025

The Setup: An iconic company with the dominant market share in film invented digital camera in 1975. Then it shelved the technology so it could keep selling film.

The Decision: Ignored its own innovation to protect its film business.

The Blunder: Made the wrong choice in an innovator’s dilemma. Underestimated competitors’ ability to also develop digital photography.

The Fallout: Kodak filed for a Chapter 11 bankruptcy reorganization in 2012. And in August 2025, it issued a “going concern” warning, saying its finances “raise substantial doubt about the Company’s ability to continue as a going concern.”

What It Cost: Tens of billions in lost market capitalization, a lost opportunity and a company that became a shell of its former self.

Lessons:

Innovations won’t stay on the shelf forever.

Cannibalize your company before others do.

A solid legacy business offers no promise in the fast of fast-evolving technology.

Blunder Rating: 🔥 8.5/10

Read More: Momma don’t take my Kodachrome (Business Blunders)

PLEASE SHARE THIS FREE BLUNDERS LIST

FTX Collapse – 2022

The Setup: FTX, founded by Sam Bankman-Fried, rose rapidly to become one of the world’s largest cryptocurrency exchanges, valued at $32 billion.

The Decision: Used customer funds to cover risky bets at sister hedge fund Alameda Research while marketing FTX as a safe, trustworthy platform.

The Blunder: A balance-sheet leak exposed the commingling of funds. A liquidity crisis followed, and billions in customer assets evaporated.

The Fallout: FTX declared bankruptcy, Bankman-Fried was sentenced to 25 years in prison for fraud, and crypto markets plunged globally.

Lessons:

A lack of oversight and corporate governance in financial services can lead to disaster.

Silicon Valley doesn’t always pick winners. Sometimes it picks losers.

A young, supposed brainiac can’t be trusted with large sums of money.

Cost: Estimated $8 billion to $10 billion in customer funds lost.

Blunder Rating: 🔥 10/10

Read More: Sam In The Slam (Business Blunders)

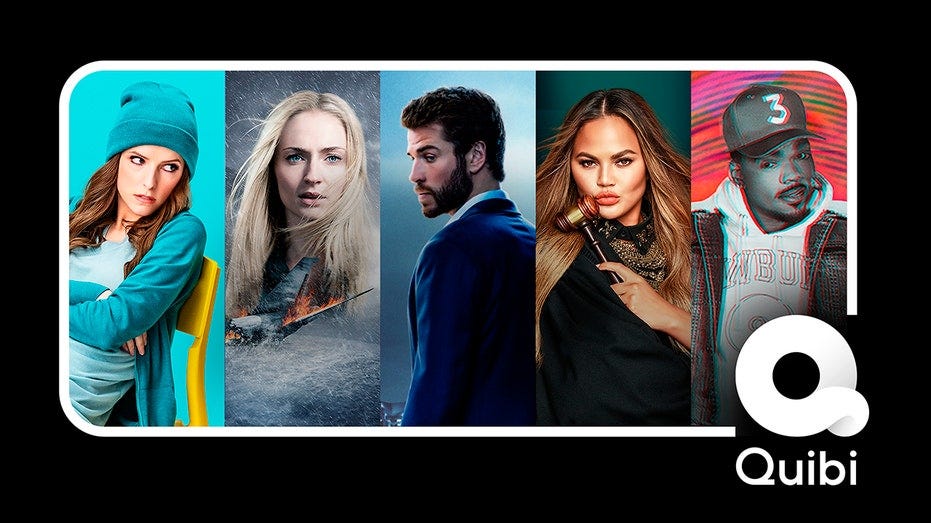

Quibi’s Instant Implosion – 2020

The Setup: Movie mogul Jeffrey Katzenberg and former Hewlett-Packard CEO Meg Whitman raised nearly $2 billion to create a short-form video streaming service.

The Decision: Launched Quibi in 2020, betting people wanted “premium” 10-minute shows.

The Blunder: Thinking people would pay for short videos when TikTok was free. Spending outrageously on talent, including paying Reese Witherspoon $6 million for voiceover work on six-minute episodes of a nature series.

The Fallout: Quibi shut down in just six months.

Lessons:

You can’t brute-force consumer behavior with money.

You can’t charge for what competitors give away free.

Big names in Hollywood and business don’t succeed at everything.

Cost: $1.75 billion gone in less than a year.

Blunder Rating: 🔥 9/10

Read More: They built it, but people did not come: the cautionary tale of Quibi (The Guardian)

WeWork’s IPO Implosion – 2019

The Setup: WeWork branded itself not as a flexible workspace company, but as a revolutionary “tech” startup transforming office life.

The Decision: Pursued a highly publicized initial public stock offering at a $47 billion valuation, while founder Adam Neumann maintained unusual control and burned through cash at alarming rates.

The Blunder: The IPO filing revealed staggering losses, questionable governance, and eccentric leadership behavior.

The Fallout: The IPO collapsed, Neumann was forced out, and SoftBank bailed the company out at a fraction of its peak valuation.

Lessons:

Inflating valuations with hype and style will backfire.

Governance and business fundamentals matter.

Too much control in the hands of one man is a recipe for losses.

Cost: Valuation collapsed from $47 billion to under $10 billion.

Blunder Rating: 🔥 9/10

Read More: Why did WeWork fail, and what is next for the company? (Reuters)

Boeing 737 MAX Crisis – 2018

The Setup: Boeing was under pressure to compete with Airbus’s fuel-efficient A320neo.

The Decision: To save time and money, Boeing updated the existing 737 design with larger engines instead of designing a new plane, relying on software to mitigate handling issues.

The Blunder: The software was poorly explained to pilots, lacked redundancy and was not disclosed clearly. The result was two fatal crashes – Lion Air 610 in 2018, Ethiopian Airlines 302 in 2019 – that killed 346 people.

The Fallout: The 737 MAX was grounded worldwide for nearly 20 months, costing Boeing billions in lost revenue, settlements and reputational damage.

Lessons:

Cutting corners on safety to save costs destroys trust.

Transparency and pilot training are non-negotiable in aviation.

Too much focus on quarterly results and lead to long-term disasters.

Cost: Over $20 billion in direct costs, plus long-term brand damage.

Blunder Rating: 🔥 10/10

Read More: Con Air: Fly the felonious skies with Boeing (Business Blunders)

Elon Musk’s Costly Tweet – 2018

The Setup: Tesla founder Elon Musk grew increasingly frustrated with short sellers.

The Decision: Tweeted about taking Tesla private at $420 a share, claiming the funding for this transaction was secured.

The Blunder: Musk’s claim triggered an investigation from the Securities and Exchange Commission.

The Fallout: Tesla and Musk were slapped with $40 million in fines. Musk stepped down as chairman. Investors sued, but a jury found Musk didn’t commit fraud.

Lessons:

Tweets can move markets and provoke regulators.

CEOs must check their egos before jumping into a fray.

When it comes to public statements that can affect stock prices, the truth matters.

Cost: About $10 billion wiped from Tesla’s market capitalization. Fines of $40 million. And the tweet was perhaps the expensive 61 characters in history.

Blunder Rating: 🔥 7.5/10

Read More: Jury Musk didn’t defraud investors with 2018 Tesla tweets (Associated Press)

Samsung Galaxy Note 7 Recall – 2016

The Setup: Samsung developed a flagship smartphone aimed at premium leadership with a compressed launch cycle.

The Decision: Shipped them all over the world with ultra‑dense batteries under tight tolerances.

The Blunder: Volatile batteries led to runaway fires and an initial recall replaced phones with similarly risky units.

The Fallout: Global bans on flights. Full discontinuation of product. Loss of market share. Shattered trust in the brand.

What It Cost: About $17 billion in lost sales and direct costs.

Lessons:

Reliability is a feature that customers can’t see until it disappears.

A recall must be decisive and final.

The supply chain should be as strategic as the design.

Blunder Rating: 🔥 8/10

Read More: Note 7 fiasco could burn a $17 billion hole in Samsung accounts (Reuters)

Theranos Fraud – 2015

The Setup: Theranos, founded by Elizabeth Holmes, promised to revolutionize healthcare with a device that could run scores of tests on a single drop of blood.

The Decision: Raised hundreds of millions from investors and cut deals with Walgreens and Safeway while keeping its technology secret and unverified.

The Blunder: The technology never worked as promised. Investigative reporting exposed the deception.

The Fallout: Theranos collapsed, Holmes and Chief Operating Officer Sunny Balwani were convicted of fraud, and investors lost nearly everything.

Lessons Learned:

Vision and charisma can’t replace working technology.

Transparency and peer review are essential in health tech.

Silicon Valley is a sucker for tech hype.

Cost: More than $900 million in investor losses and extreme reputational damage to Silicon Valley.

Blunder Rating: 🔥 10/10

Read More: A Bloody Mess (Business Blunders)

JC Penney’s Fumbled Transformation – 2011-2013

The Setup: JC Penney was struggling yet still a household name.

The Decision: Hired Apple retailing superstar Ron Johnson to transform a struggling retailer. Johnson, credited with creating the Apple store, scrapped coupons, discounts and sales thinking customers wanted Apple-style elegance.

The Blunder: Failing to understand the extent to which discounts and sales drove JC Penney’s core business.

The Fallout: Johnson was fired in less than 2 years and JC Penney’s decline accelerated.

Lessons:

Know your customers.

Don’t expect to change the culture of a business overnight when it’s been around for more than a century.

What works for emerging electronics might not work for declining department stores.

Cost: Billions in lost revenue and brand damage.

Blunder Rating: 🔥 7.5/10

Read More: The 5 Big Mistakes That Led to Ron Johnson’s Ouster at JC Penney (Time)

Volkswagen Dieselgate – 2015

The Setup: A global auto giant makes an aggressive diesel expansion in the U.S. and European Union amid tightening emissions rules.

The Decision: Installed software to cheat emissions tests.

The Blunder: Deliberate law‑breaking. Failure to recognize electric vehicles and hybrids as the superior low-emissions technology.

The Fallout: Global recalls. Years of litigation and enduring reputational harm. Top leadership churn. Criminal prosecutions and an aging former CEO still awaiting trial as of August 2025.

What It Cost: More than $30 billion in fines, buybacks and remediation.

Lessons:

Cheating can cost far more than compliance.

A culture that normalizes corner‑cutting invites disaster.

Regulatory risk is enterprise risk.

Blunder Rating: 🔥 8.5/10

Read More: Slipping Away From Prosecutors (Business Blunders)

Deutsche Bank’s Fat Finger – 2015

The Setup: An international banking giant dealing with a complex settlement process for structured financial instruments.

The Decision: Someone accidentally entered the gross instead of the net amount on a huge fund transfer.

The Blunder: A whopping $6 billion wired in error. Controls didn’t catch the error before the money was sent. Getting the money back was a process that embarrassed the entire firm

The Fallout: Money returned. Phew! But controls needed a complete review and a reputational bruise took years to heal.

What It Cost: Operational pain and $6 billion briefly at risk.

Lessons:

Large settlements require stringent controls.

The platform user experience for high‑stakes inputs must prevent obvious mistakes.

“Human error” is a design problem.

Blunder Rating: 🔥 5.5/10

Read More: Deutsche Bank handed a hedge fund $6 billion on a 'fat finger' error (Business Insider)

Microsoft Buys Nokia – 2013

The Setup: Microsoft wanted to compete with Apple and Android in smartphones.

The Decision: Bought Nokia’s phone division for more than $7 billion.

The Blunder: The Windows Phone never caught on with consumers or developers.

The Fallout: Microsoft wrote off $8 billion, effectively killing its phone ambitions.

Lessons:

You can’t buy market dominance when you’re too late to the trend.

A merger can’t always save a company losing market share to competitors.

Technology moves faster that mergers.

Cost: A writer-off of more than $8 billion.

Blunder Rating: 🔥 8.5/10

Read More: Microsoft axes 7,800 after disastrous $7.6bn Nokia failure (Wired)

Google Glass Lands On Its Ass – 2013

The Setup: Google hyped “Glass” as the future of wearable tech.

The Decision: Sold unfinished prototypes for $1,500 to early adopters.

The Blunder: Privacy fears, poor battery life, and lack of clear use for these horrendous-looking spectacles.

The Fallout: Glass was discontinued for consumers within two years.

Lessons:

Wearable products require fashionable designs.

Who wants to meet somebody with a camera on their face? Is it on? Why are you recording me?

Don’t launch a prototype as a mass-market product.

Cost: Hundreds of millions in wasted research and development, but what’s a few hundred million to Google?

Blunder Rating: 🔥 6.5/10

Read More: Google Glass Is Gone—Here's Why VR Needs to Learn From That Failure (Lifewire)

BP Deepwater Horizon – 2010

The Setup: High‑pressure, deepwater drilling to meet production targets. Tight timelines and cost pressures.

The Decision: Proceeded with risky drilling plans despite warning signs and known safety gaps.

The Blunders: Well integrity failures. Lax safety culture. Crisis response missteps, including a CEO who tried to minimize the disaster by saying a big ocean could handle the damage.

The Fallout: Largest marine oil spill. Criminal and civil penalties. A multiyear cleanup and a long-standing erosion of trust.

What It Cost: About $65 billion in fines, settlements, cleanup and other related costs.

Lessons Learned:

Safety shortcuts can compound into catastrophes.

Crisis plans require resources and drills.

To overcome a disaster, a company needs credible management.

Blunder Rating: 🔥 9/10

Read More: Lewis: BP’s Hayward is haywired on spill, er, leak (Dow Jones/Denver Post)

Lehman Brothers Bankruptcy – 2008

The Setup: A highly leveraged investment bank loaded with mortgage risk.

The Decision: Piled on more leverage and illiquid assets as the housing cycle sparked a global financial crisis.

The Blunders: Underestimating risk. Accepting poor collateral. And a crisis communications effort that came too late for a government bailout.

The Fallout: The largest bankruptcy in U.S. history at the time. Systemic contagion. Emergency policy interventions for rival firms.

What It Cost: The end of the nation’s fourth-largest investment bank, which traced its roots back to 1844. About $613 billion in liabilities listed in its bankruptcy filing, plus colossal value destruction for shareholders and distrust of the entire global financial system.

Lessons:

Liquidity evaporates quickly when confidence breaks.

Leverage amplifies bad judgements.

Companies need living wills just in case they die like this one.

Blunder Rating: 🔥 10/10

Read More: The Collapse of Lehman Brothers: A Case Study (Investopedia)

Bernard Madoff Ponzi Scheme – 2008

The Setup: Investors revered a former Nasdaq chairman turned investment peddler, who was touting a track record that was just too good to be true.

The Decision: Instead of admitting poor performance, Madoff ran a decades‑long scam, paying old investors with new money in a classic Ponzi scheme.

The Blunder: Fabricated statements. Ignored red flags. And a reliance on a phony reputation.

The Fallout: Collapsed during the financial crisis. Criminal convictions. Life‑altering losses for victims.

What It Cost: About $65 billion in reported paper losses.

Lessons:

If returns never vary, be suspicious.

Trust needs verification.

Concentration risk isn’t just about assets. It’s about money managers, too.

Blunder Rating: 🔥 10/10

Read More: Married To Madoff (Business Blunders)

BlackBerry Dismisses the iPhone – 2007-2010

The Setup: Research in Motion’s BlackBerry was the smartphone leader with more than a 50% market share.

The Decision: Executives dismissed the iPhone with co-CEO Jim Balsillie calling it “one more entrant into an already very busy space.”

The Blunder: The company ignored touchscreens and apps while clinging to mechanical keyboards.

The Fallout: Market share collapsed to near zero.

Lessons:

Consumer preferences can change swiftly amid emerging technology, even to the point of switching from keyboards to touchscreens.

Market leadership is not guaranteed to last forever.

Arrogance blinds companies to seismic shifts.

Cost: Tens of billions in market value evaporated.

Blunder Rating: 🔥 9/10

Read More: How Blackberry Fell (The New Yorker)

Yahoo Misses Google And Facebook – 1998-2006

The Setup: Yahoo was the dominant internet portal of the late 1990s and early 2000s.

The Decision: The company passed on buying Google for $1 million in 1998. Later, it passed on a chance to acquire Facebook for $1 billion.

The Blunder: Twice ignoring transformational Internet companies.

The Fallout: Yahoo faded into irrelevance. It eventually sold for $4.8 billion in 2017.

Lessons:

Smaller competitors may have something to teach you.

Don’t underestimate competition in an age of rampant technological changes.

Maintaining market dominance often requires strategic acquisitions.

Cost: Missing out on possibly trillions in combined market value and market domination.

Blunder Rating: 🔥 9/10

Read More: How Yahoo Blew It (Wired)

Enron Collapse – 2001

The Setup: Wall Street loved Enron company, blissfully unaware of the complex trading and bogus accounting it deployed to fuel relentless growth.

The Decision: Hid debt in off‑balance‑sheet entities and use mark‑to‑model revenues to sustain the illusion.

The Blunders: Systemic accounting fraud. Fatal conflicts of interest with the auditor, Arthur Anderson. Executives cashing out leaving investors with the mounting risks..

The Fallout: Bankruptcy. Auditor run out of business. Executives jailed. Sweeping governance reforms follow.

What It Cost: About $63 billion in assets wiped and vast shareholder value destroyed.

Lessons:

Transparency is a better path to success than deceitfully engineered earnings.

Independence is non‑negotiable for the board and the auditors.

Bad incentives create bad behavior.

Blunder Rating: 🔥 10/10

Read More: Enron Was A Parody Of Itself (Business Blunders)

Borders Partners with Amazon – 2001

The Setup: A struggling book store needed an online sales strategy.

The Decision: Outsourced online book sales to Amazon.

The Blunder: Customers went straight to Amazon. Borders trained them to shop online instead of its stores.

The Fallout: Borders filed for bankruptcy in 2011.

Lessons:

Don’t fail to track shifts in consumer shopping behavior.

If you don’t innovate, you will stagnate.

Never steer your customers to your biggest rival.

Cost: Borders lost everything. Amazon became the untouchable book seller.

Blunder Rating: 🔥 8.5/10

Read More: Borders files for bankruptcy, to close 200 stores (Reuters)

AOL-Time Warner Merger – 2000

The Setup: AOL dominated dial‑up Internet access. Time Warner owned premium cable TV content. Dot‑com euphoria made the “old” and “new” media seem like a profitable matchup.

The Decision: The companies announced a $165 billion, stock‑swap merger in January 2000, banking on a synergy that never came together.

The Blunders: The move came just before the dot-com bubble blew. AOL stock cratered. A culture clash stalled integration. And the plan for synergies didn’t really exist.

The Fallout: The combined company posted a record loss. It brand and employee morale sank. And the company ended up spinning off AOL years later.

What It Cost: The company took a $99 billion write down, and suffered a decade of distraction.

Lessons:

Don’t peg mega‑mergers to market hype.

Integration involves people, not just spreadsheets.

Stock‑swaps always amplify valuation risk. It’s often just funny money.

Blunder Rating: 🔥 9.5/10

Read More: How the AOL-Time Warner Merger Went So Wrong (New York Times)

Blockbuster Rejects Netflix – 2000

The Setup: Blockbuster was the king of movie rentals with 9,000 stores worldwide. Netflix was a fledgling DVD-by-mail service.

The Decision: Netflix’s Reed Hastings offered to sell the company to Blockbuster for $50 million.

The Blunder: Blockbuster executives laughed Hastings out of the room.

The Fallout: Netflix grew into a $200 billion streaming titan. Blockbuster filed for bankruptcy in 2010.

Lessons Learned:

Be careful not to underestimate a disruptor.

Retail locations are expensive. The Post Office, which Netflix used before streaming to deliver DVDs, is not.

Dismissing innovations as small can topple giants.

Cost: Roughly $200 billion in missed market value.

Blunder Rating: 🔥 9/10

Read More: Lessons from the Rise of Netflix and the Fall of Blockbuster (Cato Institute)

MySpace Loses to Facebook – 2000s

The Setup: MySpace was the dominant social network of the early 2000s.

The Decision: News Corp. acquired MySpace for $580 million and focused on aggressive ad monetization and customization over user experience..

The Blunder: Ignoring Facebook, which provided a cleaner, more trusted platform. buying a company no one at News Corp. really understood.

The Fallout: MySpace’s traffic collapsed. News Corp sold it for just $35 million.

Lessons:

User experience trumps short-term monetization.

Early entrants to a new industry don’t always win the race.

A legacy media company needs to explore different strategies to succeed in new industries.

Cost: More than $500 million and missing out on a trillion-dollar industry.

Blunder Rating: 🔥 9/10

Read More: MySpace – what went wrong: ‘The site was a massive spaghetti-ball mess’ (The Guardian)

Long‑Term Capital Management – 1998

The Setup: Star traders and Nobel laureates made trades that worked … -—until they didn’t.

The Decision: Put extreme leverage on “low‑risk” spreads.

The Blunder: Grossly underestimated risk. Made correlated bets that collapsed together.

The Fallout: Required a rescue plan from the Federal Reserve, which feared this single hedge fund’s blunders could take down the entire global economy. The event led the hedge fund industry to reexamine their models.

What It Cost: $4.6 billion in losses mitigated by a $3.6 billion bailout from private firms that the Fed rallied.

Lessons:

Diversification without independence between investments is an illusion.

Risk analysis does not always consider the worst-case scenario.

Size your positions for surprises, not sunshine.

Blunder Rating: 🔥 9/10

Read More: The Epic Story Of How A 'Genius' Hedge Fund Almost Caused A Global Financial Meltdown (Business Insider via Wayback Machine)

Quaker Oats Snaps Up Snapple – 1993

The Setup: Basking in the success of its Gatorade brand, Quaker made a big bet on another beverage rocket ship.

The Decision: Acquired Snapple for $1.7 billion at the peak of the brand’s market hype.

The Blunder: Overpaid. Botched integration and brand positioning.

The Fallout: Fire‑sale exit for $300 million just 27 months later.

What It Cost: About $1.4 billion in value destruction.

Lessons Learned:

Pay for current performance, not for potential.

Protect what makes an acquired brand unique and loved.

Expected synergies are often illusions.

Blunder Rating: 🔥 7.5/10

Read More: Quaker-Snapple: $1.4 Billion Is Down the Drain (Los Angeles Times)

Gerald Ratner’s “Crap” – 1991

The Setup: Ratners was a United Kingdom jeweler with popular but low‑priced products.

The Decision: More of an impulse than a decision to joke that products were “crap.”

The Blunder: Trashing the product.

The Fallout: Share price plunge. Leadership change. Multi‑year effort to repair the brand.

What It Cost: About £500 million in market value.

Lessons Learned:

Respect your customer’s purchase.

Don’t denigrate the product.

Humor can bomb. Really bomb.

Blunder Rating: 🔥 7.5/10

Read More: Gerald Ratner's 'crap' comment haunts jewellery chain (The Guardian)

New Coke – 1985

The Setup: Pepsi taste‑test gains spooked Coca‑Cola.

The Decision: Replaced the flagship formula nationwide.

The Blunder: Didn’t realize the taste test research was framed for sips, not full consumption. Misread emotional brand loyalty. No graceful rollback plan.

The Fallout: Outrage and a rapid rebranding of the original formula as “Coca‑Cola Classic.”

What It Cost: Tens of millions in lost revenues. But it’s a big company and the blunder arguably reinforced brand over time. Still, this blunder is so memorable that it remains a popular anecdote to this day for what not to do in business.

Lessons:

Don’t mess with an icons.

Research must mirror real‑world use.

Reversing a bad decision has to be transparent and strategic.

Blunder Rating: 🔥 7/10

Read More: Why Coca-Cola’s ‘New Coke’ Flopped (History.com)

IBM Hands PC Power to Microsoft – 1980s

The Setup: IBM wanted an operating system and software for its new personal computers.

The Decision: Licensed Microsoft’s MS-DOS instead of owning it outright.

The Blunder: IBM let Microsoft keep the rights ot MS-DOS.

The Fallout: Microsoft dominated the software industry. IBM faded from PC dominance.

Lessons:

Hardware isn’t as valuable as software, which an be licensed to multiple computer makers.

Don’t use your brand to build a competitor’s company.

Giving away the core of the platform can be fatal.

Cost: Hundreds of billions in lost opportunity and market dominance.

Blunder Rating: 🔥 9/10

Read More: IBM Signs A Deal With The Devil (thisdayinhistory.com)

Penn-Central Merger – 1968-1970

The Setup: Two declining railroads trying to fend off trucks, cars and airlines.

The Decision: Merged Pennsylvania and New York Central railroads without a credible turnaround plan for the combined entity.

The Blunder: Ignored corporate culture and union frictions. Misjudged capital requirements. Fought against a macro-economic trend.

The Fallout: Bankruptcy in two years. A government restructuring of U.S. rail.

What It Cost: Largest U.S. bankruptcy at the time and a massive loss in shareholder value.

Lessons Learned:

Strapping two listing ships together doesn’t build a cruise liner.

Integration requires a clear command structure.

Fix operations before putting them together.

Blunder Rating: 🔥 8/10

Read More: Penn Central Railroad (West Virginia Encyclopedia)

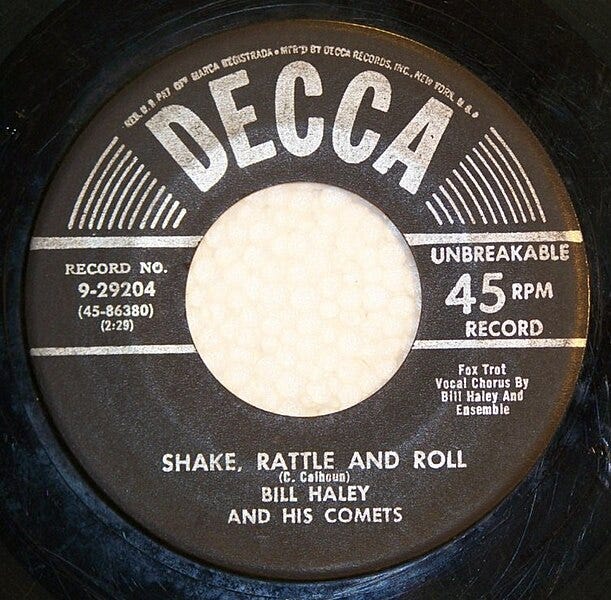

Decca Rejects The Beatles – 1962

The Setup: Decca Records was a major label auditioning new talent.

The Decision: Rejected The Beatles, saying “guitar groups are on the way out.”

The Blunder: They signed The Tremeloes instead. Anyone heard of Tremeloes lately?

The Fallout: The Beatles became the most successful band in history.

Lessons:

Dismissing trends too early can backfire spectacularly.

Don’t be arrogant when making subjective decisions.

Guitar music has been around since the 16th century and isn’t going away any time soon.

Cost: Lost billions in record sales, tours and cultural dominance.

Blunder Rating: 🔥 8.5/10

Read More: Remember When: Decca Records Turned Down The Beatles (American Songwriter)

Ford Edsel – 1957-1960

The Setup: Ford wanted to dominate the mid-size car market.

The Decision: Launched the Edsel, hyped as the “car of the future” after making significant market research into the rising economic affluence of American car buyers.

The Blunder: The car was overpriced, ugly and released during a recession.

The Fallout: Ford lost $250 million and killed the brand after just 3 years.

Lessons:

Hype can’t replace a genuine product-market fit.

Timing matters. This was the wrong car for the wrong market at the wrong time.

Market research has limitations.

Cost: $250 million in 1950s dollars or about $2.5 billion in today’s dollars.

Blunder Rating: 🔥 8/10

Read More: What Happened to the Car Industry’s Most Famous Flop? (Time)

Thank you for this fascinating read.