Biggest Business Blunders Of 2025

It was a year of forbidden love, economic anxiety, corporate breakups, bankruptcies, CEO resignations, Jeffrey Epstein, and the Tesla Chainsaw Massacre

“Look, even bad years are pretty good years I think.” – Robert Downey Jr.

Before fully jumping into the new year, don’t forget what happened last year. Here’s a recap of the biggest business blunders of 2025.

Kissing away all that CEO money

When you’re CEO, you shouldn’t be dating the hired help or handing out lucrative corporate contracts to your lover.

In 2025, Nestlé CEO Laurent Freixe was fired for an undisclosed romantic relationship with a subordinate. Kohl’s CEO was fired after reportedly giving his girlfriend a multimillion-dollar consulting contract. And most memorably, Andy Byron, the CEO of a startup called Astronomer, resigned after attending a Coldplay concert.

Byron was spotlighted on a Jumbotron while canoodling his HR director Kristin Cabot. Their panicked reaction prompted Coldplay frontman Chris Martin to call them out: “Either they’re having an affair or they’re just very shy.”

“I was so embarrassed and so horrified,” Cabot said in a December New York Times interview. “I’m the head of H.R. and he’s the C.E.O. It’s, like, so cliché and so bad.”

Cabot lost her job, and that should have been the end of it. But unfortunately, the Internet is a cruel place, and she’s still the target of cold shoulders from friends and associates, doxxing and even death threats in what became #coldplaygate online.

Read More:

Smile And Wave (Business Blunders)

The Chocolate Lover (Business Blunders)

Million-Dollar Baby (Business Blunders)

Lost In Love (Business Blunders)

The recession that keeps getting away

Economists warned of a looming recession throughout Joe Biden’s presidency, and they continued to chirp like Chicken Littles as Donald Trump took the reins.

In April, Trump’s tariff tantrum sent the stock market down about 10%, but it closed the year near all-time highs, buoyed by rampant AI spending.

During April’s panic, major Wall Street banks, including JPMorgan Chase and Goldman Sachs, upped their odds for a 2025 recession. So did many other observers. But it never came.

“I think we’re very close, if not in, a recession now,” BlackRock CEO Larry Fink told CNBC in April.

Torsten Slok, chief economist at Apollo Global Management, qualified his call for a recession based on whatever the hell Trump would actually do with tariffs, beyond the bluster.

“If they stay at these levels, we will absolutely have a recession in 2025,” he said on CNBC in April.

At the time, Trump was threatening triple-digit tariffs on many countries, products and commodities. But he often backed off, eased down or delayed implementation. By November his moves resulted in a rise in the effective tariff rate of about 17% – which is still the highest it’s been since 1935, but not as bad as initially announced.

So here’s where we are now: The nation’s gross domestic product is expected to show annual growth of about 1.9% for 2025, according to a Federal Reserve Bank of Philadelphia survey. That’s down sharply from 2.8% growth in 2024, but hardly recessionary.

Also, there’s been no progress on inflation, but at least it didn’t get worse. Despite Trump’s promise to end inflation on day one, the consumer price index has clocked in at 2.7% for the 12 months ending in November, which is exactly where it was last year at this time.

Still, Americans remain unhappy about an economy Trump promised to fix. Job growth has slowed dramatically. At 4.6%, the unemployment rate is at the highest level in five years, and it’s up from 4.2% from the same period last year.

Consumer sentiment plunged throughout the year and remains 30% below where it was under Biden. Consumer confidence peaked in January and has been on the decline for the past five consecutive months. Consequently, Trump’s approval rating on the economy is what’s actually in a recession.

Read More:

The Idiot Economy (Business Blunders)

Trumpflation (Business Blunders)

Stop Counting! Stop Counting! (Business Blunders)

The Tesla Chainsaw Massacre

Elon Musk spent 2025 enraging the kind of people who might buy an EV.

He swung far to the right with his politics and then he took a chainsaw to goverment jobs after President Trump put him in charge of the Department Of Government Efficiency.

Musk spent about a quarter billion dollars backing Trump only to watch his sponsored president let EV tax incentives expire. Then Musk got into a public spat with Trump that he could not win.

No surprise that Tesla sales fell 9% in 2025. And that Tesla’s Chinese competitor BYD has unseated it as the world’s biggest electric vehicle maker.

Nevertheless, Musk is still on track to become the world’s first trillionaire. Tesla stock dipped below $215 in April but it’s finished the year around $450.

Read More: Musk Chickens Out To TACO

Exiting X

Linda Yaccarino must have finally realized the blunder she made taking a job from Musk as CEO of X. She quit in July, saying very little about her decision.

Yaccarino had to know what she was getting into with Musk’s endless antics. But in 2023 she left a top job at NBCUniversal to be with him. At NBCUniversal, she was responsible for more than $10 billion in annual revenue and oversaw all global, national and local advertising sales and partnerships.

Now she’s peddling GLP-1s at some relatively unknown health management startup called eMed Population Health.

Read More: Better To Be An Ex-CEO Than An X CEO

Doing Business With Epstein

Jeffrey Epstein had been a registered sex offender since 2008. Anyone maintaining a “professional relationship” with him after that date has explaining to do.

As the Epstein files slowly trickled out, the explanations coming from Goldman Sachs General Counsel Kathy Ruemmler, former Treasury Secretary Larry Summers, celebrity guru Deepak Chopra, and others, set new lows in our anything-for-money economy.

Read More:

Networking With A Pedophile (Business Blunders)

Meditations With A Sex Offender (Business Blunders)

Winter Is Coming For Summers (Business Blunders)

Too Big To Jail (Business Blunders)

JPMorgan Chastened

What an embarrassing year for the big, swinging dealmakers at JPMorgan Chase.

First, a young charlatan named Charlie Javice was sentenced after ripping them off for $175 million by selling them a bogus internet startup. Then they have to pay for her criminal defense thanks to the contract language in the deal they struck with her.

Then Javice’s lawyers started billing the bank for luxury hotels, upscale restaurant meals, first-class air fares, and a dizzying array of incidentals, including $529 worth of gummy bears and cellulite cream for their flabby asses.

So far, lawyers for Javice and her convicted co-executive Oliver Amar have billed JPMorgan Chase for $142 million. And so far a judge is making the bank pay.

Read More:

JPMorgan Chumps (Business Blunders)

JPMorgan Chase Can Check Their Butts (Business Blunders)

It’s A Bear Market For JPMorgan Chase (Business Blunders)

All that’s ailing UnitedHealth

When CEOs decide to step down for “personal reasons,” you can bet it’s not to spend more time with their long-neglected families.

UnitedHealth Group CEO Andrew Witty made a surprise exit in May. And it was for “personal reasons,” the company said in a press release.

Witty abandoned a job paying him annual compensation of $26 million because … well …

Maybe it’s the ongoing criminal investigation into fraudulent Medicare billing practices. Or the denial-of-care outrage it engenders. Or the populist cheers for suspect Luigi Mangione following the cold-blooded murder of UnitedHealthCare CEO Brian Thompson. Or maybe it was just the more than 40% drop in UnitedHealth’s stock price.

Take your pick. This health care giant is sick.

Read More:

UnitedHealthScare (Business Blunders)

Natural Born Killers (Business Blunders)

Kicking guests to the curb

Get Out! That’s essentially the message Marriott International gave some of its guests when it ended its relationship with San Francisco-based Sonder Holdings in November.

Somehow an iconic name in the hospitality industry had partnered with an overextended, short-term rental company, and the breakup was messier than a Hollywood divorce.

Some guest got notices to immediately vacate despite their long-planned trips. Others were simply locked out of their lodging. Many spent hundreds or thousands of dollars more to find last-minute accommodations.

Social media posts raged, headlines screamed, and it may be a long time before some people will ever check into a Marriott again.

Read More: Getting Sondered

Cash for clunkers

The 2008 financial crisis began on used car lots when issues with subprime auto lending presaged far bigger issues with mortgage lending and debt securities.

In 2025, two huge bankruptcies sounded the alarm and embarrassed some of the nation’s biggest lenders, including JPMorgan Chase, Fifth Third Bank, Jeffries Financial Group, UBS and Blackstone.

In September, both Tricolor Holdings – a once-prominent subprime auto lender and used car dealer – and First Brands Group – an auto parts conglomerate – filed bankruptcy.

Tricolor executives have been charged with fraud. And investigators are still sifting through the wreckage at First Brands trying to figure out where $2.3 billion went.

Read More:

Going All Enron On Them (Business Blunders)

Parts Is Parts (Business Blunders)

Crypto tycoon? No, crypto buffoon.

Crypto crook Do Kwon received a 15 year sentence in December for perpetrating a $40 billion fraud. Prosecutors called his Terraform Labs one of the largest financial frauds in all of history.

In an age of crypto hype and astonishing overconfidence, venture capitalists lavished the 30-something Stanford grad with loot. Firms – including Arrington Capital, Coinbase Ventures, Galaxy Digital, and Lightspeed Venture Partners – fell all over themselves in the fear of missing out on something so new, nobody could really understand it.

At the top of his game, Kwon mocked his social media critics as “idiots” and haughtily told one of them:“I don’t debate the poor on Twitter.” Then, after his critics proved absolutely correct, he split the country and had to be extradited back to the U.S. to face trial.

Read More:

Kwon Don’t (Business Blunders)

Sorry Seems To Be The Hardest Word (Business Blunders)

Bad Oompa-Loompa

The risk manager turned out to be one of the biggest risks at Mars Inc.

In September, Paul R. Steed, 58, pleaded guilty to stealing more than $28 million from the company through a complex scheme involving sugar trade credits. He carried an impressive title: “Global Price Risk Manager for Mars Wrigley’s Global Cocoa Enterprise.”

Forget about the 100 Grand Bars. Steed took the gum and candy maker for a Doublemint.

Read More: Mars Bars (Business Blunders)

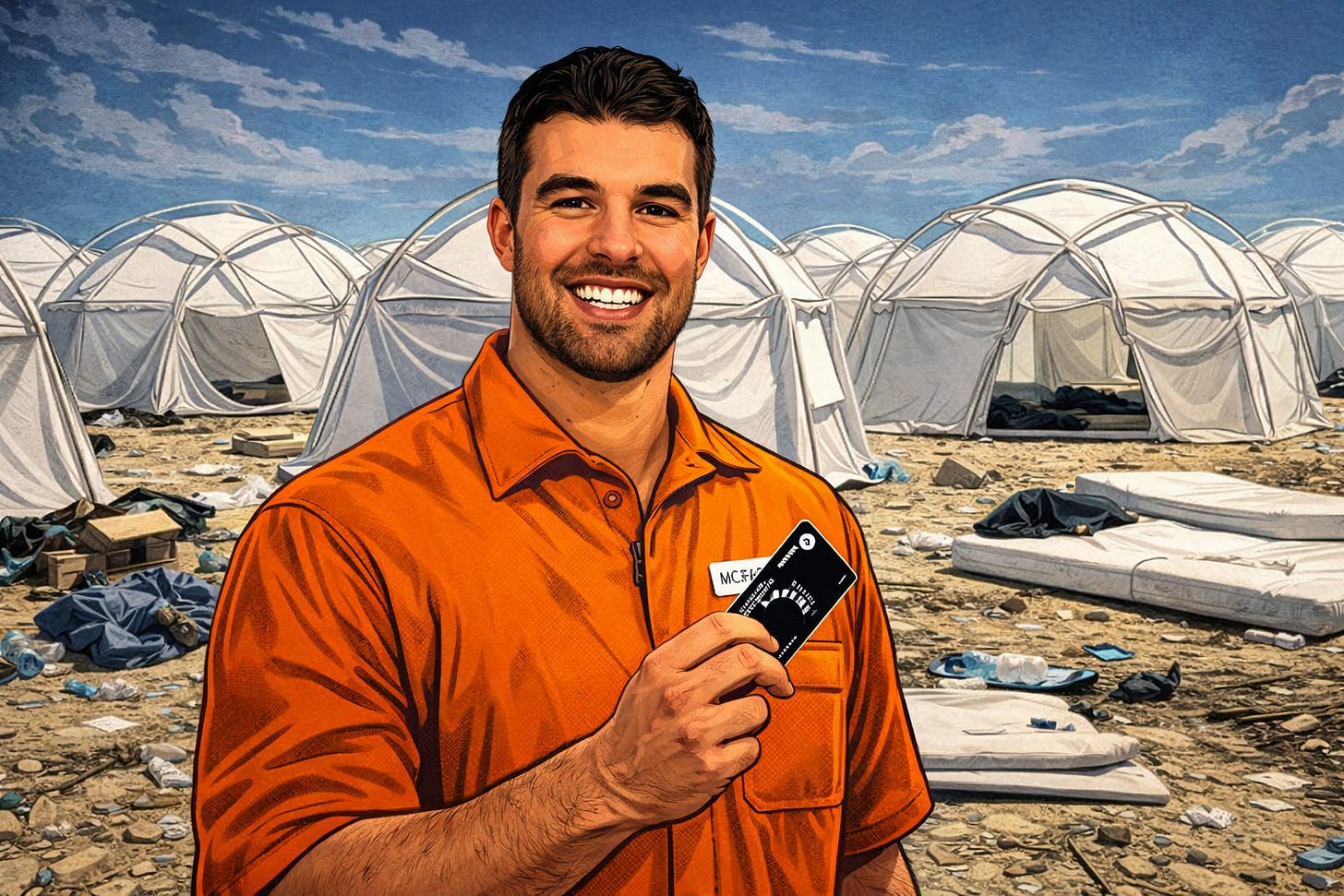

Still Playing With Fyre

After Billy McFarland got out of prison after his infamous Fyre Festival scam, he started selling $25,000 tickets for Fyre 2.

It was supposed to be a three-day event on Isla Mujeres off the coast of Cancun, Mexico, from May 30 through June 2, 2025. But of course, it didn’t happen.

Overcoming a prison sentence is one thing, but two documentaries on his Fyre debacle by both Netflix and Hulu are not easily overcome.

Nevertheless, McFarland somehow pulled off a music festival in Honduras in December, dubbed PHNX. He had artists, fans, bathrooms and at least something that resembled food. Just a few hundred people attended, it got little notice from the press, and it probably ran at a loss.

It wasn’t exactly what you’d call a phoenix rising from the ashes.

Read More:

All Fyred Up Again (Business Blunders)

Billy McFarland – Fyre Festival (Business Blunders Hall Of Shame)

Even Buffett Blunders

It turns out mixing H.J. Heinz Co. and Kraft Foods Group in 2015 wasn’t such a tasty recipe.

In September, the combined food giants announced they would split. It only took 10 years and a 60% decline in shareholder value to come to this realization. And the move brought Warren Buffett, who championed the merger, to a moment of reflection as he finally approached his retirement at age 95.

“It certainly didn’t turn out to be a brilliant idea to put them together,” he told CNBC, “but I don’t think taking them apart will fix it.”

Read More: Buffett’s Big Blunder

Here’s to a whole new year of blunders

Thank you readers for sticking with me though yet another year of stomach-churning business news. I hope you were able to laugh at developments that should leave us all crying.

Financial history repeats itself because it’s almost impossible to keep up with its endless follies.

Just like our toxic politics, the latest outrage is often enough to make us forget the last one. But it’s important to keep track if there is any hope for a fair and honest economy.

Thanks, especially, to my paid subscribers, and to my many free subscribers who share, like and comment on my work Your support means so more than I can express.

Happy New Year.

– Al

Read More:

Best-Read Blunders Of 2025 (Business Blunders)

The Biggest Business Blunders Of 2024 (Business Blunders)

Thank you for a lot of good reads, Al. When will they ever learn? Wishing you a happy and healthy New Year! 😊