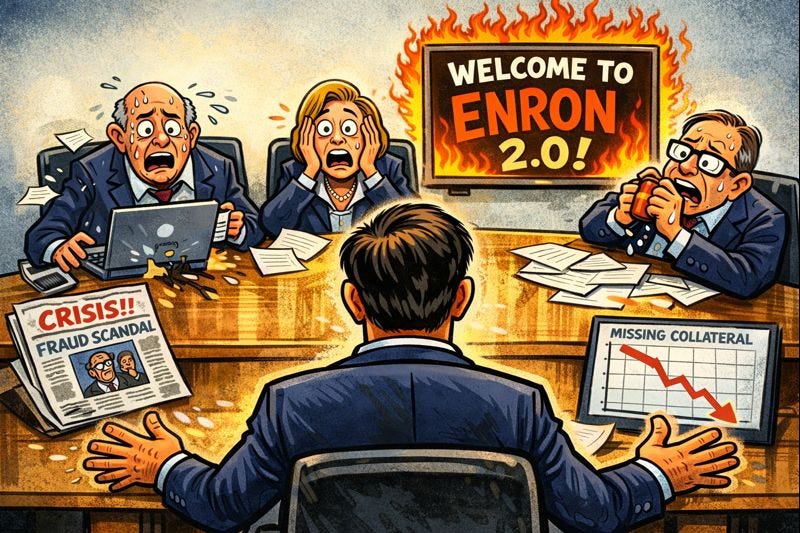

Going All Enron On Them

Before subprime auto lender Tricolor imploded, its CEO allegedly proposed one of the dumbest stunts in corporate history

“I know this is going to end bad, but I’m going to pretend it’s going to end good.” – Johnny Knoxville

The game was almost up for Tricolor Holdings, a once-prominent subprime auto lender and used car dealer. After loaning the company hundreds of millions of dollars, lenders suspected the collateral they’d received didn’t exist.

CEO Daniel Chu came up with a daring, but astonishingly stupid plan, according to a fraud indictment against him and other top executives that was unsealed on Tuesday.

Chu planned to flat out tell one of his lenders they were right. And that Tricolor’s books were so bad, it was going to be the next Enron. And wouldn’t they look stupid loaning all that money to the next Enron? How’d they like to explain that one to their bosses and their boards and their shareholders? Huh?

Perhaps it’d be best to keep quiet about all this and negotiate like banksters. Know what I mean?

“Enron obviously has a nice ring to it, right?” Chu laughs as he discusses the plan with his top executives.

“I mean, Enron, Enron raises the blood pressure of the lender … Who wants to be thrown in the category?”