UnitedHealth Scare

This Week In Blunders - May 11-17

When CEOs decide to step down from their multimillion-dollar gigs for “personal reasons,” you can bet it’s not to spend more time with their long-neglected families.

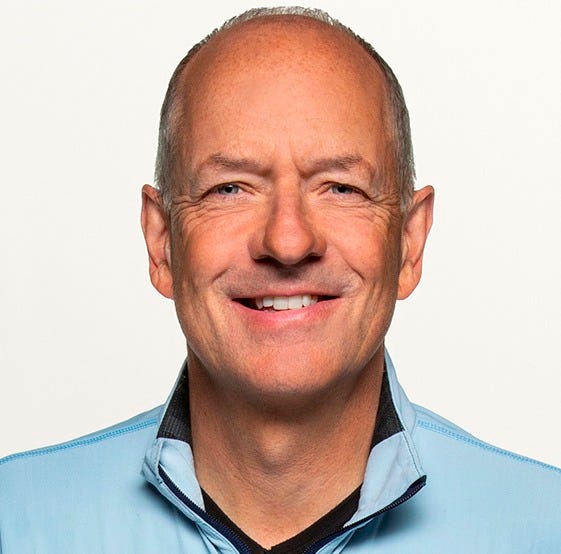

UnitedHealth Group CEO Andrew Witty made a surprise exit on Tuesday, sending shares of the company into a nosedive. It was for “personal reasons,” the company said in a press release.

Witty is abandoning a job paying him annual compensation of $26 million because … well, it’s personal.

And that’s Sir Witty to you, commoner.

As the former CEO of British pharmaceutical giant GlaxoSmithKline, Witty was knighted in 2012 for services to the U.K. economy and pharmaceutical industry.

Some services this knight in tarnished armor provided here.

In April, he presided over UnitedHealth’s first earnings miss since 2008, and its stock is down 42% year-to-date. But that may be the least of Witty’s “personal reasons.”

One day after his resignation announcement, The Wall Street Journal reported that UnitedHealth is “under criminal investigation for possible Medicare fraud.” The company responded in a press release, saying that it has not been notified by the Justice Department and called the report “deeply irresponsible.”

Time will tell who is deeply irresponsible. For now, it’s abundantly clear that the health care giant hasn’t been responsible to its customers or its shareholders.