Get That Mouse Out Of The House

Disney will pay a price for suspending Jimmy Kimmel, but how much?

This Week In Blunders – Sept. 14-20

“Free speech isn’t just about speaking. It is also about listening.” – Tim Cook.

I had dinner with a friend last night and the first thing he told me was that he just cancelled Hulu. He’s hardly alone.

People are cancelling Disney streaming services and calling for boycotts of the brand after its network, ABC, suspended Jimmy Kimmel for his comments about the Charlie Kirk shooting.

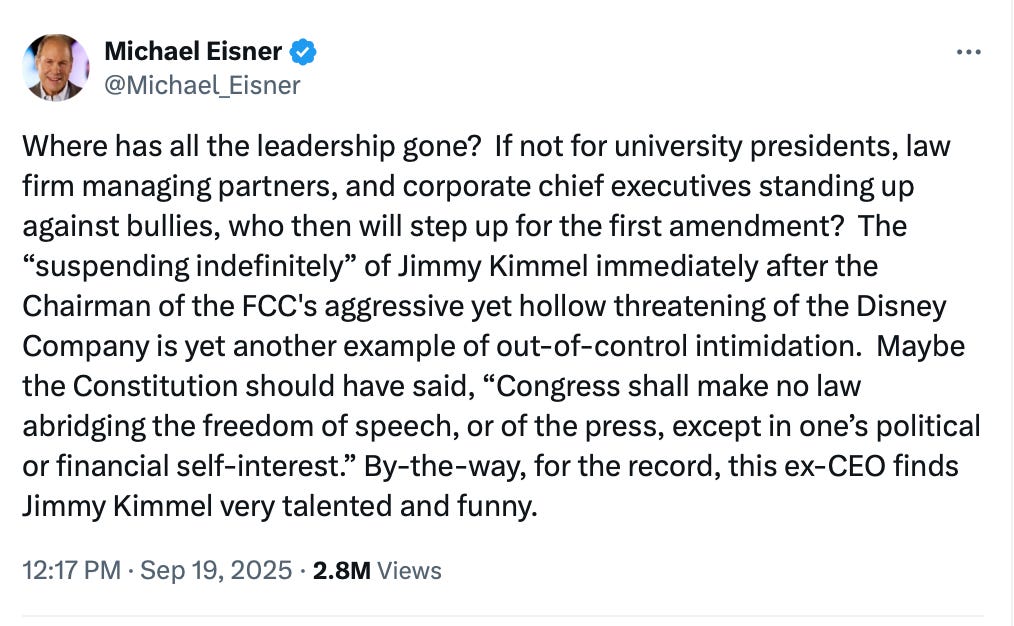

Google searches for “cancel Disney Plus” and “cancel Hulu” are spiking. And even Disney’s former CEO Michael Eisener is taking the entertainment giant to task for “not standing up against bullies.”

It remains to be seen what all this blowback will cost The Walt Disney Co. But for now, two things are painfully obvious: Charlie Kirk did not deserve to be murdered and Jimmy Kimmel did not deserve to be ousted.

And both developments are an affront to our nation.

As so many others have already done, I could rail on about the First Amendment, abuse of government power, free markets, and cancel culture. I could scream about what a terrible blunder Disney has made for capitulating to a cowardly threat by Brendan Carr, our highly partisan chairman of the Federal Communications Commission. But for now I’d like to leave all that bluster to the editorial board of that liberal rag known as The Wall Street Journal.

Here are a few choice lines from the newspapers’ editorial today:

“Anyone who thinks this is the free market at work is ignoring the ways government can punish companies.

“Compared to the malevolent garbage on social media about Kirk and his killer, Mr. Kimmel’s words were only mildly offensive.

“As victims of cancel culture for so long, conservatives more than anyone should oppose it. They will surely be the targets again when the left returns to power.

“The political cycle of using government to punish opponents is taking the country into dark corners that will result in less freedom, and less free speech, for all sides. The best immediate remedy is getting the FCC out of the business of regulating media.”

Getting off scot-free at the SEC

The Securities and Exchange Commission had a busy week – not bringing cases, but dropping them against fraudsters who already received mercy from President Donald Trump.

The SEC dropped its case against former Ozy Media founder Carlos Watson, who was was convicted of defrauding investors and ordered to pay nearly $97 million in penalties. Trump commuted Watson’s 11-year prison sentence in March.

The former CNBC host lied about everything from revenue, cash-on-hand, profits, celebrity ties, acquisition prospects and contract negotiations, according to evidence exhibited in his trial. He also participated in an infamous phone call with Goldman Sachs executives in which his right-hand man impersonated a YouTube executive.

Nikola founder Trevor Milton also caught a big break. Investors lost millions buying stock of the electric truck maker, and in December 2023, Milton was sentenced to four years in prison for defrauding them. Trump pardoned Milton in March. Nikola had agreed to pay a $125 million civil penalty in a 2021 settlement.

Then there’s Devon Archer, a financial advisor convicted of defrauding pension funds and a Native American tribe out of $60 million. Better known as the former business partner of Hunter Biden, Archer received clemency in March and now the SEC is backing off him too.

Restitution? Forget about it.

Victims? Lick your own wounds.

Deterrence? Please.

Regulatory credibility? Where?

We are living in the Golden Age of Grift. Just make sure you’re politically aligned and steal enough to buy a “Get Out Of Jail Free” card in case you get caught.

A check-kiting banker

When you’re in the banking business, you’ve got to live like a banker, even if you’re running a small community bank in gritty East St. Louis.

Andrew P. Blassie, 70, on Thursday received more than five years in prison after defrauding the Bank of O’Fallon out of nearly $2 million.

Blassie was the No. 2 executive at the bank, so he was able o conceal a childishly rudimentary fraud for about a year. He deposited bogus checks in his personal checking account at his own bank and spent with abandon as he covered his tracks.

Blassie also conned a couple from Lebanon, Ill., out of $489,000 by selling them promissory notes. Before he defaulted on the notes, he used some of his hot-check proceeds to pay them interest, prosecutors said.

“He defrauded the bank of approximately $2 million through a check kiting scheme that he used to enrich himself,” said Special Agent in Charge Vincent Zehme, of the Federal Deposit Insurance Corp. in a press release.

Blassie scrubbed his name and account number from suspected check-kiting reports.

Did he think the best way to rob a bank was to run one? Lots of white-collar defendants do. But most of them are smart enough to avoid writing bad checks. Banks charge fees for that.

Don’t Miss These Blunders

Lap Dance Dollars Executives from world's largest publicly traded strip club company allegedly bribed a public auditor to dodge $8 million in sales taxes

From Baby Shower To Prison Shower Ian Gregory Bell celebrated with 75 guests. Six days later, he got three years.

If You Build It, Chumps Will Come A father-and-son team fleeced municipal bond investors out of more than $280 million with an Arizona sports-park nightmare

Reefer Madness The CEO behind Jim Beam and Maker's Mark resigns over CBD use

Buffett’s Big Blunder At least the world's most-admired investor can admit he was horribly wrong about Kraft Heinz

The Chocolate Lover Nestlé CEO Laurent Freixe just joined a litany of top executives who've lost their jobs to love

The Apprentice Movie producer behind Trump biopic faces 300 years in prison for alleged scams of his own

The Biggest Business Blunders Of All Time And the costly lessons they left behind.

Timeshare Prison This week In Blunders – Aug. 17-23

Instant Ponzi – Just Add Water This Week In Blunders – Aug. 10-16

Doing That Shuffle A former JPMorgan Chase and Goldman Sachs executive raised $4.3 million to start a blockchain gambling app. Then he allegedly blew his seed money in another online casino.

Kwon Don’t Terraform Labs founder Do Kwon never planned on failure. Now he's headed to prison after pleading guilty to a $40 billion crypto fraud.

Sub Moron This Week In Blunders – Aug. 3-9

Near Intelligence On Epstein Island This company tagged everyone who came and went to the infamous pedophile paradise. Now, its top executives are charged in an unrelated accounting fraud.

We have the power, in our pocketbooks, our wallets, to shut down Disney and Hulu. "Don't panic, organize".

With all of these scam scummers getting jail time and having to pay back in some form the investors, it just blows me away that a member of this club his name being Tim Krieger of MN got away with scamming over 900 note holders for years with his company Aspirity Holdings and the Courts with tons of solid evidence in front of them, let the criminal walk free. The court system of MN is just as corrupt as the criminal himself. And Mr. Krieger had to be laughing his deceptive head off at the MN Court knowing that he was able to fool them along with the 900 investors.