Former Goldman Sachs Group Inc. director Rajat Gupta received a two-year prison sentence and a $5 million fine in 2012 for securities fraud.

He was convicted of feeding confidential information to Raj Rajaratnam, a former hedge fund manager sentenced to 11 years in prison for running one of the biggest insider-trading rings ever exposed.

It was never shown Gupta directly profited from these trades, but it was shown that he had a long-running business relationship with Rajaratnam.

This is not how one is supposed to handle confidential information at Gupta’s level.

Gupta once ran McKinsey & Co., one of the world’s largest consulting firms, with tentacles in many of the world’s largest companies, including Enron. He was a managing director there as the energy giant imploded in one of the world’s most infamous corporate meltdowns.

Gupta also sat on the board of Procter & Gamble Co. and American Airlines.

He got off easy on the insider trading charges considering that prosecutors had asked for more than 10 years. But he had a lot of fans.

Before Gupta’s sentencing, the judge received hundreds of letters attesting that Gupta was a great friend, a loving husband, an attentive father and a passionate humanitarian.

“No leader of the private sector or corporate world has invested so much of his time, energy and personal credit to do so much for the poorest people of the poorest countries than Rajat Gupta,” wrote Barry Bloom, professor at the Harvard School of Public Health.

These letters clearly played into his light prison sentence.

“The Court can say without exaggeration that it has never encountered a defendant whose prior history suggests such an extraordinary devotion, not only to humanity writ large, but also to individual human beings in their times of need,” Judge Rakoff wrote in sentencing Gupta.

Humanitarianism aside, prosecutors said Gupta’s crime was as damaging to Wall Street as just about any other exposed in the aftermath of the financial collapse of 2008.

“It understandably fuels cynicism among the investing public that Wall Street is rigged and that Wall Street professionals unfairly exploit privileged access to information,” prosecutors wrote in a sentencing memorandum. “This is particularly troubling at a time when there is widespread concern about corruption, greed, and recklessness at the highest levels of the financial services industry.”

The fact is, good people do bad things. Bad people do good things. And the issue before any court should be whether they did it.

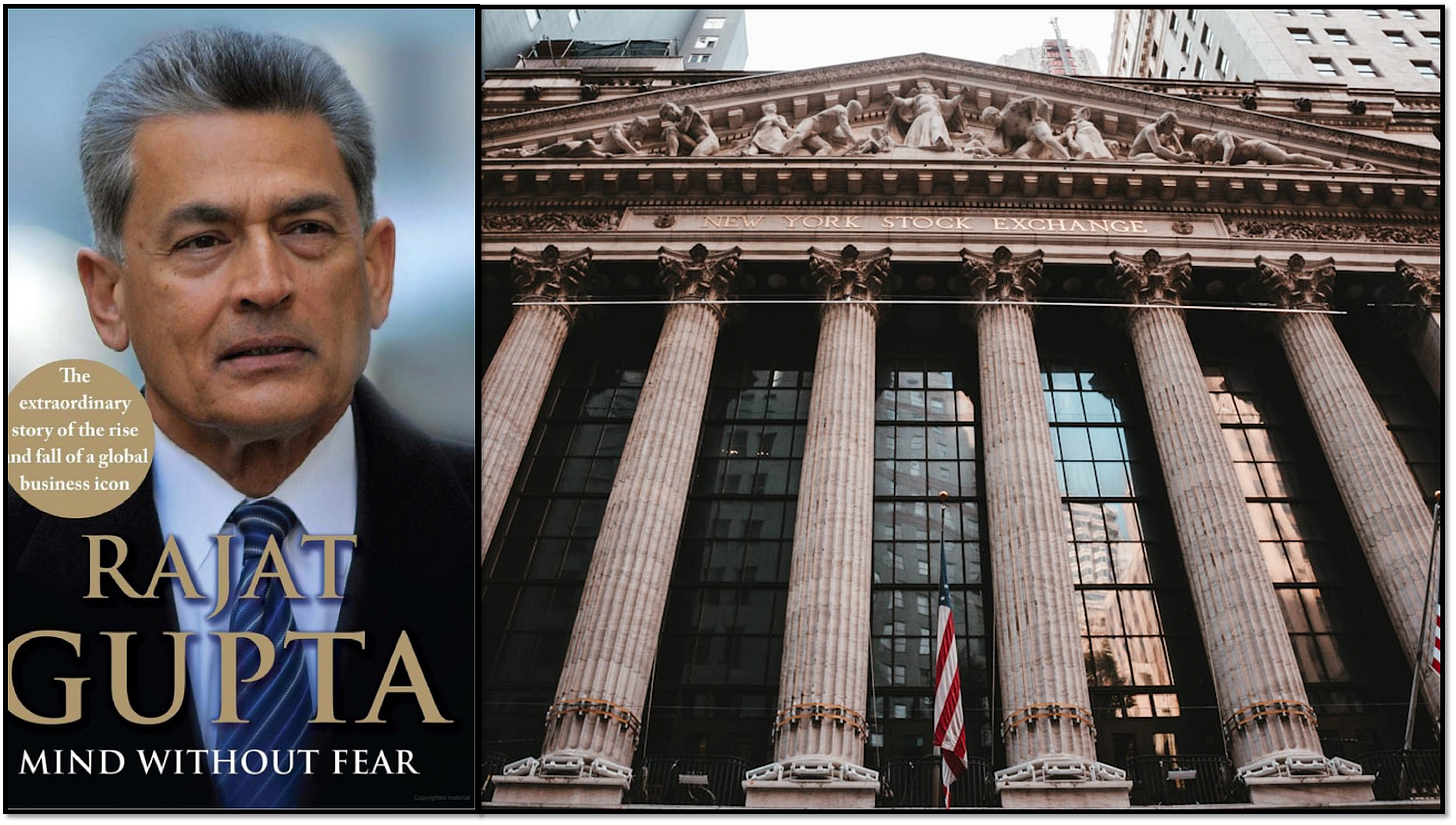

In 2019, Gupta wrote a book to tell his side of the story and insist on his innocence, Mind Without Fear. It could have alternatively been called Mind Without Contrition.

“This is the most unusual case in insider trading history,” he said in an interview after the book’s release. “There is no benefit, no establishment of criminal intent. They made up a case, and they succeeded.”