Raj Rajaratnam – Galleon Group

He got the longest prison sentence ever for insider trading. He called it 'Uneven Justice.'

Raj Rajaratnam was one of the highest-profile insider-trading targets of former U.S. Attorney Preet Bharara following the 2008 financial collapse.

Bharara successfully prosecuted Rajaratnam for bagging $63.8 million in illicit profits from 2003 to 2009, trading in such stocks as eBay, Goldman Sachs and Google. A federal judge sentenced Rajaratnam to 11 years, the longest prison sentence ever imposed on an insider-trading convict.

Rajaratnam got many of his tips from former Goldman Sachs Group Inc. director Rajat Gupta, who was also prosecuted. They were longtime business associates and even played bridge and chess together in prison.

Rajaratnam came to the U.S. from Sri Lanka and founded Galleon Group, a hedge fund that at one time managed about $7 billion in assets and employed 180 people.

“Raj Rajaratnam stood at the summit of Wall Street, commanding his own financial empire,” Bharara said following the judge’s ruling. “Mr. Rajaratnam stood convicted 14 times over of felonies, his empire exposed as a web of fraud and corruption that entangled many. … It is a sad conclusion to what once seemed to be a glittering story.”

But it wasn’t quite the end. Life for Rajatnam went on, even behind bars.

“I went to bed overnight with a clear conscience and slept well,” Rajaratnam said in a 2021 interview with Forbes. “I felt I cleared my name but the jury saw it different. When they did, I walked into prison with my head high.”

A federal correction officer saw to it that Rajaratnam had an easy prison stay. William S. Tidwell, 50, of Keene, New Hampshire, pleaded guilty to taking $90,000 in benefits and getting a $50,000 loan from an “ultra-high net worth” inmate, identified as Rajaratnam.

Read More: Billionaire Prison Time (Business Blunders)

Rajaratnam was not charged in that case and he was released in 2019 after serving nearly eight years.

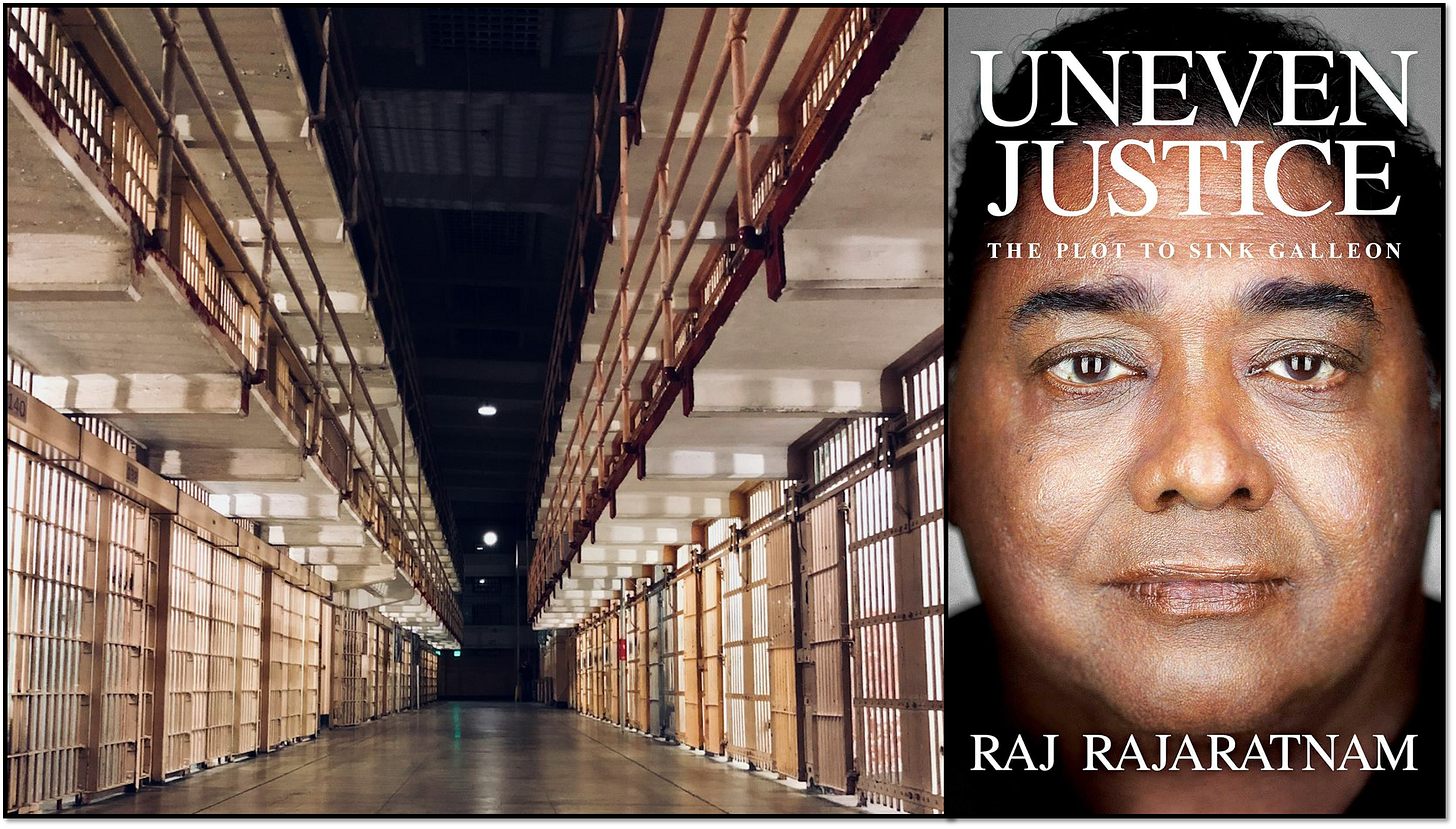

After serving his time, Rajaranam published a woe-is-me memoir, “Uneven Justice,” in 2021, alleging prosecutorial overreach. Instead of getting a fair trial, he claims he was scapegoated for the 2008 financial crisis.

He used the charity defense in proclaiming his innocence, as if people who do good things would never do bad things.

“I just want to correct you on one thing,” he said in a 2021 CNBC interview. “I did not make a single cent. If everything I did was illegal, the money went to the investors. Right? It didn’t come to Raj Rajaratnam’s pocket. I gave more to charity than what was alleged that I was made. So how can you call me greedy?”