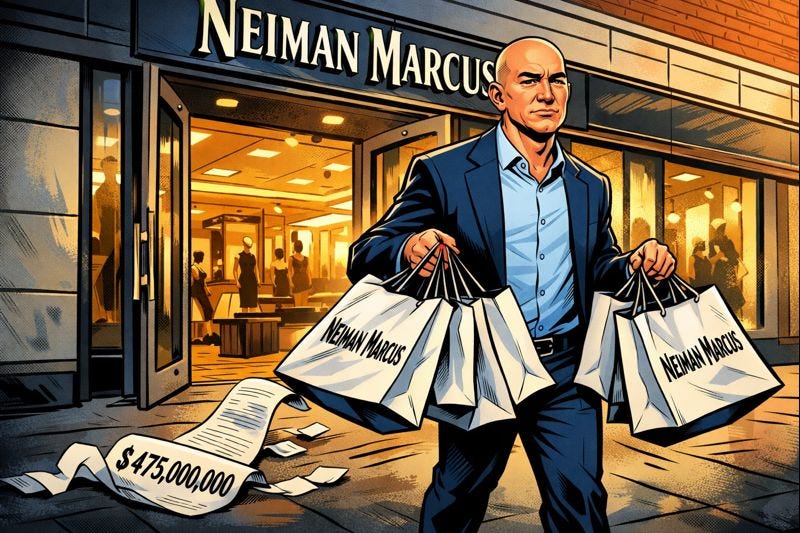

Needless Markup

Amazon’s $475 million bet on the Saks-Neiman Marcus merger goes to zero in bankruptcy court

This Week In Blunders – Jan. 11-17

There is nothing so useless as doing efficiently that which should not be done at all.” – Peter Drucker

You can always pay more for luxury at Neiman Marcus and one the richest companies in the world wasn’t afraid to do just that.

But now Amazon wants a refund on the $475 million it invested in Saks Global’s $2.7 billion takeover of Neiman Marcus in December 2024.

As expected, Saks Global filed bankruptcy on Wednesday. Within hours, the online retailing giant objected to the financing plan for the Chapter 11 restructuring, saying it would cement its massive loss.

Read More: Sacking Saks (Business Blunders)

“That equity investment is now presumptively worthless,” Amazon’s attorneys wrote in a court filing. “Saks continuously failed to meet its budgets, burned through hundreds of millions of dollars in less than a year, and ran up additional hundreds of millions of dollars in unpaid invoices owed to its retail partners.”

What did Amazon think would happen? That shoppers with too much money would click for a $180,000 Artemest x Kiton Bespoke Trunk? Yeah, just stick one of those in a smiling cardboard box and leave it on the porch.