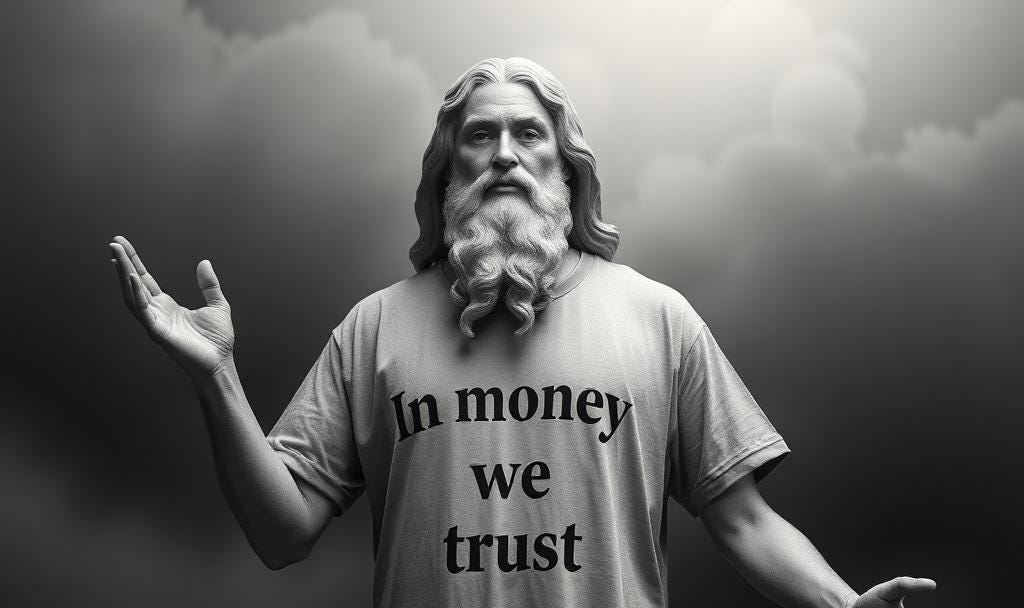

The Gods Or Money?

A new book, "The Almightier," pulls back the temple curtains and reveals what mankind really worships

“No man can serve two masters; for either he will hate the one and love the other, or else he will hold to the one and despise the other. Ye cannot serve God and mammon.” – Matthew 6:24

Two-thousand years ago, Jesus Christ offered mankind an unambiguous choice, God or mammon, and today our decision is about as clear as ever: We love money. We idolize money. We worship money.

It has always been this way, but we haven’t always noticed, despite centuries of unbridled greed and financial scandals within organized religions of every stripe.

My former colleague from The Wall Street Journal, and fellow Substacker, Paul Vigna, has done a remarkable job of chronicling one of mankind’s biggest blunders in a book released this week, “The Almightier: How Money Became God, Greed Became Virtue, and Debt Became Sin.”

As Vigna writes, we live in a world where everything is done for money.

If you doubt his thesis, maybe you should stop praying for financial blessings, ditch your beloved “prosperity gospel” preachers, and pick up your cross.

The acquiescent Fertile Crescent

Vigna’s exploration begins thousands of years before Christ in the ancient Mesopotamian city of Uruk. At the dawn of civilization, citizens were expected to pay tributes to keep the gods, the priests and the rulers fat and happy, but how much?