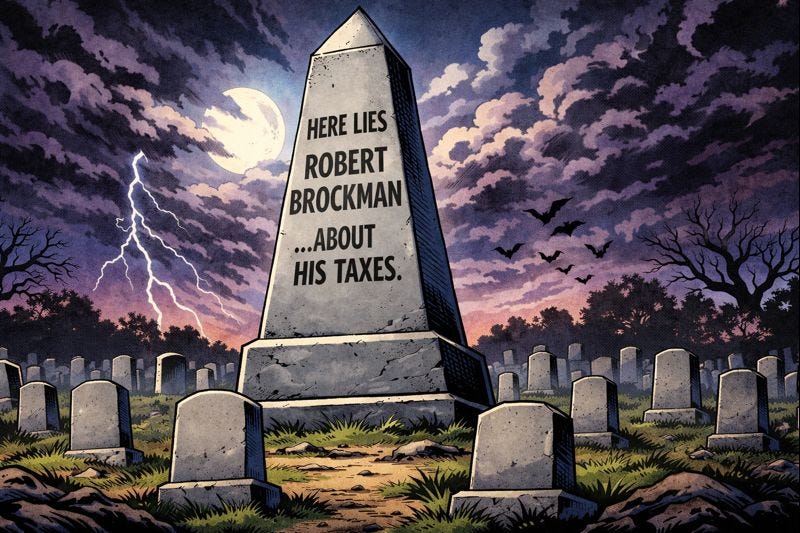

Tax Time For A Dead Billionaire

Texas businessman Robert T. Brockman coughs up $750 million from beyond the grave.

This Week In Blunders – Dec. 21-27

“You don’t pay taxes — they take taxes.” – Chris Rock.

If a dead billionaire can roll in his grave, this is likely how accused tax dodger Robert T. Brockman spent the week after his estate agreed to pay $750 million in back taxes and penalties.

Brockman should be remembered as a pioneering automotive-software entrepreneur and an early backer of private equity firm Vista Equity Partners, which boasts more than $100 billion in assets under management.

Instead, he goes down as a billionaire scofflaw who spent the final years of his life fighting what prosecutors called the biggest U.S. tax fraud case ever filed against a single individual.

Brockman died in 2022 at age 81 fighting criminal tax evasion and wire fraud charges. Prosecutors alleged that he hid more than $2 billion in income from the IRS through a dizzying array of offshore accounts, backdated records and encrypted communications.