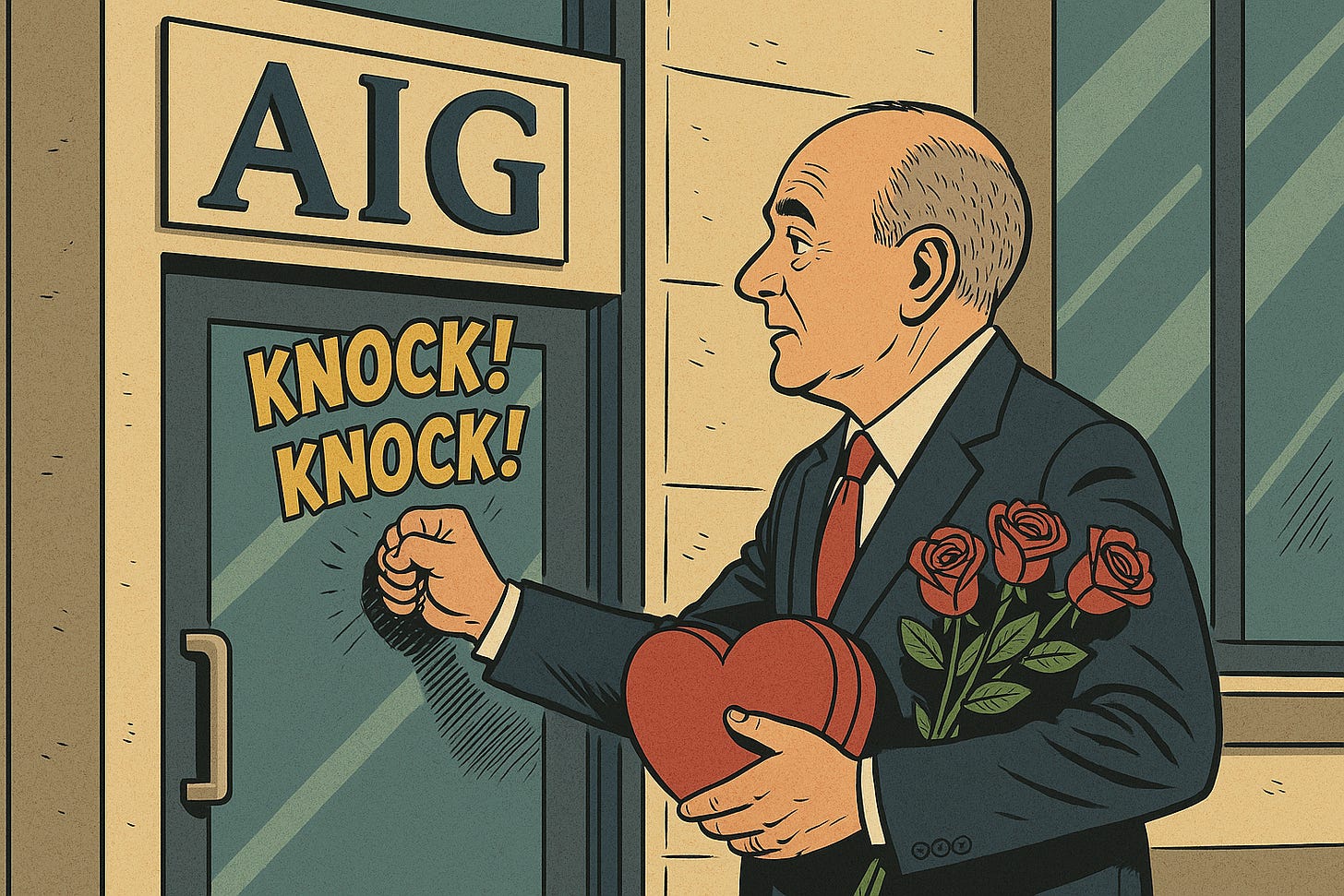

Insuring Lust

AIG can't seem to find a faithful man

This Week In Blunders Nov. 9-15

“An affair wants to spill, to share its glory with the world. No act is so private it does not seek applause.” – John Updike

Global insurance giant American International Group was just about to welcome its new president to the office when a New York Times reporter called with a simple question:

Did AIG’s board know about the office romance that preceded his resignation at one of his last jobs? It’s not like it never made the news.

The company gave the NYT a prompt answer: John Neal “will no longer be joining the company due to personal circumstances.”

Doh!

Neal failed to disclose a romantic relationship with his executive assistant when he was CEO of Australian insurance giant QBE. In 2017, the board sanctioned him by cutting his bonus by $550,000. He resigned a few months later.