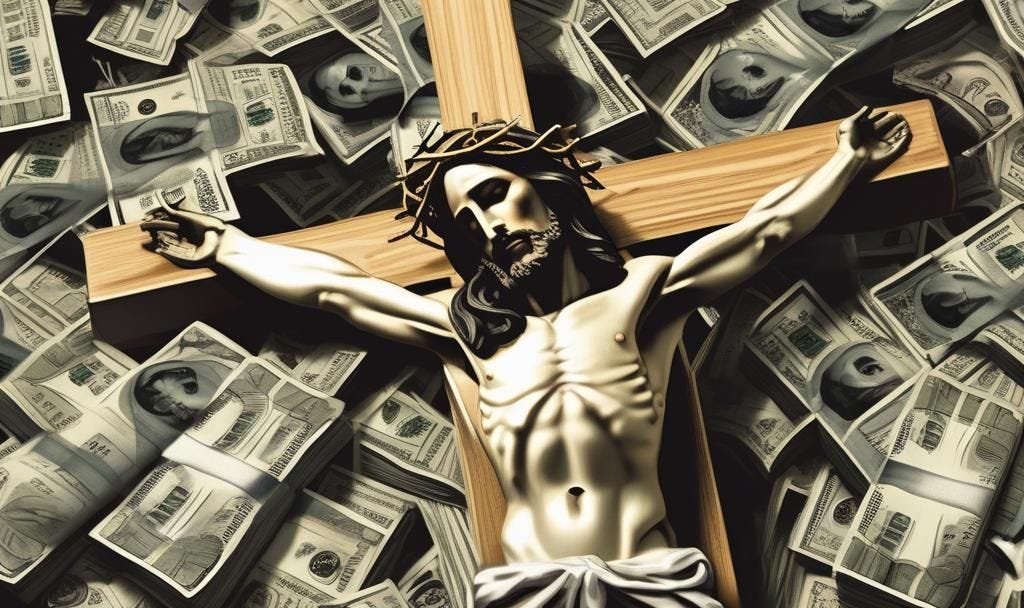

Billion-Dollar Reprobate

Bill Hwang lost billions investing 'according to the Will of God.' Now he's going to prison for cheating Wall Street banks

“Some have strayed from the faith in their greediness, and pierced themselves through with many sorrows.” – 1 Timothy 6:10

Either Bill Hwang wasn’t truly following the Holy Spirit or the Almighty has a cruel sense of humor when it comes to money.

“I try to invest according to the Word of God and the power of the Holy Spirit,” founder of Archegos Capital Management proclaimed. “It’s a fearless way to invest.”

Hwang, 60, received 18 years in prison last week after blowing up his $36 billion investment firm in March 202. He was convicted in July on 10 counts of securities fraud, wire fraud, conspiracy, racketeering and market manipulation. He was accused of lying to his lenders about his risky bets and illegally jacking stock prices.

Some of the world’s largest banks – including Nomura Holdings and Credit Suisse (now part of UBS), Morgan Stanley, and Goldman Sachs – lost a combined $10 billion lending to Archegos. Hwang, himself, saw his net worth plunge from $36 billion to $55 million, his lawyers claim. And stocks that he manipulated lost $100 billion in value, prosecutors estimated, calling it a fraud on par with Sam Bankman-Fried at crypto-exchange FTX.

‘Capitalists who serve God’

Hwang was born in South Korea in 1964 and immigrated to the U.S. with his parents in 1982. His father was a pastor, which may explain why Hwang was so preachy.

He ran his investment firm side-by-side with his Grace & Mercy Foundation – one of the largest donors to Evangelical causes, including megachurches, Focus on the Family, and the Museum of the Bible.

“Wall Street’s Most Famous Evangelical Sentenced in Unprecedented Fraud Case,” screamed the headline in Christianity Today, which devoted plenty of coverage to this fresh stain on the faith.